How to Invest In Precious Metals

How to Invest In Precious Metals

Precious metals like gold, silver, platinum, palladium, and copper are a monetary device which is capable of holding its value better and longer than paper money. They not only provide a hard asset but are also an ideal safe haven investment that has historically withstood economic downturns. Their value lies in their utility and rarity. They've always been a coveted store of wealth throughout human history.

As an investor, it's crucial that you diversify your investment portfolio by investing in as many investment vehicles as possible. This way, you can intelligently spread your risk across the assets. But even with this knowledge, many investors still find it difficult to invest in precious metals. If you've been thinking about allocating some of your money into alternative, counter-cyclical investments, you should take a closer look at gold and silver.

In this guide, we will give you a basic overview of how to invest in precious metals and look at some of the benefits of having a small allocation of your investment portfolio in gold and silver.

But first...

Why Invest in Gold and Silver?

This is a fundamental question for many people looking to diversify their investment. Well, the truth is, precious metal investors have many different motivations for investing in gold and silver. These can range from the need for longer-term investments, hedge against erosion of currency value, or desire to diversify one's portfolio.

Here are a few reasons why you should invest in gold and silver.

- Gold and Silver Never Lose Their Intrinsic Value

Unlike modern money and currencies which rely on governments to maintain their value, gold and silver are real physical commodities with intrinsic value. Today, an ounce of gold can buy roughly the same amount of goods as it did decades ago. That, however, cannot be said of a dollar bill.

Gold and silver derive their value from their rarity and numerous applications. For instance, in the United States alone, 34% of gold is used for industrial applications such as electronics and jewelry fabrication. On the other hand, silver is a 'miracle metal' whose usefulness can only be matched with oil. This widespread industrial use of both gold and silver ensures that they remain in demand, hence maintaining their value.

- Gold and silver are Counter-cyclical Investments

Today, the global economy is more susceptible to the effects of a crisis than decades ago. Financial markets tend to take the biggest hits during economic downturns. However, gold, on most occasions, performs better when the economy and the financial markets are at their worst. This positive performance of most precious metals makes them an ideal counter-cyclical investment vehicle to protect your investment when paper assets are falling.

- Gold and Silver Has Kept Pace with Financial Assets

The stock market has been on a steady rise for the past few decades. However, comparative data from 1970 to date shows that gold has matched the performance of the S&P 500, giving it a slight performance over these financial assets within the 50 years.

This exceptional performance of gold and its ability to maintain its value even in the toughest economic times makes the precious metal a reliable long-term investment to help store your wealth. This also holds for silver, which allows investors to make viable investments at half the price of gold.

- World Demand For Precious Metal Is Growing, And The Supply Is Slumping

Global demand for silver and gold has been growing consistently in the last few years. Asian economies such as China and India have pushed the demand for these precious metals, perhaps due to their cultural affinity with these metals. Industrial use for both silver and gold have also jacked up the demand.

On the other hand, some of the major gold mining countries such as South Africa have been recording decreasing capacity since 2003 that is yet to be filled up. Soon, we are likely to experiences the consequences when surging demand meets the crimped supply. All this is likely to play off to the advantage of silver and gold owners.

How to Invest In Precious Metals

Gold and silver are profitable investment alternative for both new and experienced investors who are interested in holding their investment portfolios in counter-cyclical assets. Apart from being a lucrative investment vehicle, gold is a rare metal for creating beautiful objects and jewelry. How can you add these assets to your portfolio?

Well, there are several ways you can do this.

Gold And Silver Bullion

This is perhaps the most reliable and the most popular way to invest in gold and silver. Investors prefer bullion as a way to hold an asset that will retain and perhaps expand in value in case of a potential economic meltdown. The reason being, silver of gold bullion is a safe "cash and carry asset" that has wide market demand.

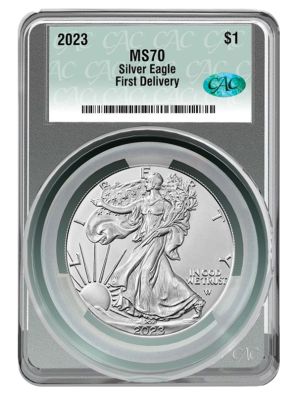

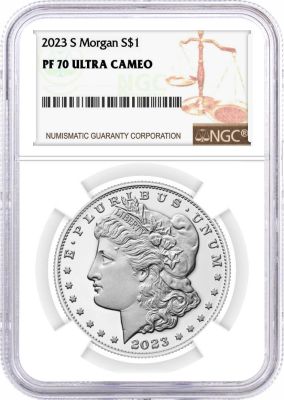

Bullions can be bought from a reputable precious metal dealer such as IPM, or a bank or brokerage in the form of coins or bars. Bullions bars are available in various sizes, ranging from quarter-ounce waffle bars to 400-ounce bricks.

However, bullion coins are perhaps the most popular choice for many investors because of their unique characteristics. Besides their inherent value, bullion coins can also carry a certain amount of collector value. While newer coins may not have much numismatic value, others such as American gold coins that were minted pre-1933 before the elimination of gold circulation have significant collectors value tied to their total price.

The South African Kruggerands and The Gold American Eagle bullion coins are some of the most preferred gold coins among investors due to their sovereign backing, worldwide recognition, and easy trading.

Gold And Silver ETFs

Investing in gold or silver-based exchange-traded funds (ETFs) is also an excellent way to diversify your portfolios. Gold and Silver ETFs are paper assets that are backed up by gold and silver. This form of investment offers a really easy way for an investor with a brokerage account to buy-in.

However, this investment holds some risks. One, you really don't own any gold or silver when buying the ETF. Instead, you'll own third-party security that can only be traded when the local stock market opens rather than round the clock, as is the case with the bullion market.

Gold or silver stocks

You can invest in gold and silver by buying shares in companies that mine the metals. This is an investment in the companies and not the precious metals. This can be a risky investment for people with minimal industry-specific knowledge of how the mining stocks are valued and how their value responds to price movements of precious metals.

Futures and options for Gold & Silver

Futures and options are standardized, exchange-traded contracts between the buyer and the seller allowing for the future sale of precious metal at a predetermined price. Usually, gold and silver are the underlying assets. This anti-inflation hedge investment vehicle is most suitable for investors who want to make huge bets on precious metals, allowing them to profit whenever there is price volatility.

Precious Metals IRAs

This is a smart investment option that combines the power of tax-exempted, government-approved retirement account with the benefits of precious metals. Ideally, precious metal IRAs allow you to own gold or silver without the hassle of storing or transporting it. The precious metal is kept in a bank vault until you decide to take distributions from your account.

Top Benefits of Investing In Precious Metals

Investing in gold and silver can be a real game-changer. Here are some key benefits of purchasing precious metals for an investment collection.

High Demand

The global appetite for precious metals has been on the rise. Surprisingly, as the demand increases, the mines for precious metals are struggling to keep up with the demand as the metals are close to exhaustion.

Easy liquidity

Gold and silver investments can be easily converted into cash whenever you need it. This makes it a top investment option for investors looking for financial security assets.

Good for diversification

The price of precious metals often runs in the opposite direction of the fiat currencies. So, whenever the economy and financial markets are down, the price of your gold or silver investment is likely to go up. By allocating some of your investment to precious metal, you can protect your entire portfolio against economic downturns hence maintaining robust financial stability.

An ideal asset for heirs

Gold and silver can easily be passed down to future generations without the risk of losing value over time.

Accepted all over the world

Gold and silver are perhaps some of the few investment assets that are accepted and can be traded around the world with ease. Whenever there is a price dip in one country, you can always sell it in other parts of the world with better market price markups.

Safe haven against inflation

Gold and silver are inflation-proof investments. They will not only protect you from a financial crisis but also protect you against inflation and ultimately protect your savings.

Gold and silver require no specialized skills and knowledge

Unlike other investment vehicles such as stocks that need significant experience before investing, no special skills or expertise is necessary to buy a gold or silver bullion.

Gold hedges the stock market

If you've invested in stocks, a gold portfolio will protect your investment. If you want an asset that will rise when most other assets fall, gold is likely to do more than that.

No counterparty risk involved

unlike paper assets, there are no counterparty risks with silver and gold.

Precious Metals Vs Stock Market

Many investors use silver and gold as a diversification tool to protect their investment against various economic downturns. But do these assets measure up during stock market upheavals? How does an investment in precious metals compare with a stock market investment?

From historical data, the price of precious metals tends to hold up even after a short or long stock market crash. In fact, in most cases, the price of gold rose during some of the biggest stock market crashes, such as the one experienced in the early 2000s.

Ideally, precious metals and the stock market are indirectly correlated. This means that the price of gold or silver is likely to shift in the opposite direction whenever there is a dip in stock markets.

Therefore, if you're looking for an asset that will continue performing even when most other assets take a downturn, gold and sometimes silver is a perfect fit. An intelligent mixture of stocks and a percentage of investment in gold and silver bullions will ensure that your portfolio remains protected regardless of the performance of your stock portfolio.

What Is the Best Metal to Invest In Right Now?

Since precious metals are traded 24 hours, their prices can be affected by a host of factors, such as consumer demand, investor demand, and industrial demand. In 2019, there was sustained growth in the demand and price for gold, silver, platinum, and palladium. Going from this trend and factoring the various demand concerns that are currently prevailing, the trend is likely to remain the same this year. Let's dive in and look at some of the best metals to invest in right now:

#1 Gold

If you're looking for a metal to invest in right now, gold is a perfect option. While gold's price is on the premier end compared to other metals, its demand around the world has remained strong, making it a perfect "safe-haven" asset. Gold is an excellent hedge during periods of economic uncertainties like the one we are currently in. It tends to hold its value during these economic slowdowns making it a long-standing favorite for investors.

#2 Silver

Silver is also a favorite among veteran investors due to its huge demand for investment and industrial use. The demand in the silver market has been very stable, with China's manufacturing sector being the world's largest consumer. Since silver's productions have slumped this year due to COVID-19, we are likely to see moderate price increases.

This possible price correction in the coming days gives a good opportunity for long-term investors to buy in right now. Its demand is also likely to skyrocket as we expect more industrial activity throughout this decade. Since we are looking at a possible prolonged financial market downturn, the best silver to buy right now would be the physical form - bullion bars and coins. This way, you can hedge your investment against inflation and unfavorable market changes.

#3 Platinum

Although gold and silver are a favorite among many investors, more people are starting to take a keen interest in platinum as an investment vehicle. Platinum is a dense, malleable element with outstanding corrosion resistance. It is 15 times rarer than gold yet has indispensable uses. The metals functionality and rarity have made it a go-to favorite for many investors looking to diversify their portfolio.

Platinum is mainly consumed by motor vehicle manufacturers to produce catalytic converters for diesel engines. It is also used in the jewelry, weaponry, and dentistry industries.

Historically, platinum's prices have been riding over gold. This has, however, changed significantly over time. Unlike gold and silver, its value relies on its utility. If car manufacturers were to drop it, the demand for platinum could be significantly affected.

#4 Palladium

Palladium is a good option for people looking to add an extra layer of diversification to their portfolios. This rare element is majorly used in automotive, jewelry, chemical, and dental industries. A while ago, palladium was not nearly as popular as it is today. But its use in gasoline-powered vehicles and the incredible economic growth in developing countries, especially China, has driven its demand through the roof.

The metal is likely to maintain this performance due to its stable and favorable supply/demand fundamentals. The metal's tight supply and growing demand suggest better prices than alternative metals. Many investors are attracted to the relatively small size of the palladium's market compared to silver and gold. You can invest in palladium by buying palladium bullion bars and coins, palladium ETFs, or palladium stocks.

#5 Copper

Copper has a lot of similarities with gold and silver due to its intrinsic value and widespread industrial value. It is extensively used across the manufacturing sector due to its excellent electrical conductivity, malleability, and heat conduction. If you'd like to invest in copper, you can either buy copper bullion, copper numismatic coins, Copper ETFs of as stock in copper mining companies.

Final Thoughts

If you're looking for ways to diversify your portfolio, precious metals are a perfect fit. They have real potential to perform well when other investment vehicles aren't and protect your entire investment. If you already haven't allocated some investment to precious metals, this is a perfect time to buy either gold or silver and hedge against the looming inflation.

When buying or selling gold or silver, it is crucial that you deal with reputable bullion dealers such as the International Precious Metals (IPM) company to ensure that you buy legit bullion and avoid being scammed. You should always check their online review and identify if they're affiliated with leading industry organizations such as the American Numismatic Association, Numismatic Guaranty Corporation, and Professional Coin Grading Service (PCGS).