Are US Mint Coins A Good Investment?

Investing In US Mint Coins

If you've been seeing the fancy US mint coins advertisements, you likely think they are a good investment. In terms of quality, US Mint coins have reliable purity levels than silver and gold bullion options.

We have all come across the consistent shopping ads that prompt an individual to purchase fancy coins made in selected limited quantities at a fantastic price. Several questions arise; for example, what are these coins? Are they genuine? Are they from US Mint? Is investing in US Mint coins a good investment? To properly comprehend whether US Mint coins are a good investment, it is vital to observe its historical background as an investment, whether Mint coins are a good investment as the bullion, and conditions that influence their investments.

So, are US Mint coins a good investment? The best answer is that an investment in US Mint Coins is subjective. This means that an individual needs to decide whether the investment from US Mint Coins is better. In this case, an individual must decide on the easiest way to purchase the US Mint coins to maximize profit.

Additionally, US mint silver coins and US mint gold coins have been around since 1964; therefore, they may not have as much value as they had in the past. However, the introduction of the US Mint bullion coins as an investment is a good investment today due to their high value. That being said, you should know the types of coins to purchase and invest in to achieve maximum profit.

In this article, we'll research more on whether an individual should purchase gold and silver as an investment, the best coin to purchase as an investment, the best ways to invest in precious metals, and platinum bullion and coins.

Where can You Purchase US Mint Coins?

The most profitable way to make profits from US Mint coins is capitalizing on the product's rarity aspect. As such, rare coins have the highest probability to fetch more money among collectors and investors. Such a realization begs for the next question, where can you purchase such rare coins?

The answer is from the US Mint website (usmint.gov), which provides easy-to-use interphase during the different purchases. The website's customer service is friendly and professional to ensure all online and offline purchases are made promptly for collectors and investors.

Should I Buy Gold/Silver as an Investment Option?

You're probably wondering; is it wise to buy Gold or Silver as an investment option? As mentioned earlier, the existence of Gold and Silver US Mint coins has led to the depreciation in the value of gold and silver. Also, there are numerous silver coins than gold coins. As such, making more profit on the gold coins is much easier on gold coins than on silver coins. It is, therefore, safe to note that old coins whether gold or silver has more value than new coins due to their aesthetic and historical value.

But even with that, many coin collectors consider most US minted coins as investments that attract premium values. More importantly, US Mint coin sets attract premium values as investments rather than collectibles. For this reason, collecting such coins with the main aim of selling them at a later date can prove cumbersome but is likely to be profitable if you know the right coins to collect and how to go about the business of coin collecting as an investment.

So, if you come across your first US coins minted, it's advisable to put them up for sale and perhaps sell them to the highest bidder. Doing so can ensure that you receive the highest profit possible, especially if they are US mint uncirculated coin sets. In line with the rarity concept discussed earlier, coins with less circulation have more value and investment worth. On this note, US Mint coins are a good investment on the premium value.

What is the best coin to buy as an investment?

From a historical point of view, the US Mint has existed for more than two centuries, and that provides enough time to produce more coinage. The coinage produced over time is substandard since mass production is the same for the US and other countries like the Philippines.

Moreover, the coins produced are subject to grading factors like surface preservation, strike quality, errors, and luster. Through such, the best coins to purchase as an investment include those with less wear and tear since they fetch the highest value for investors.

Although US Mint coins' mass production has led to some of them lacking the finesse and high quality to sell high, there are several aspects to observe before the purchase of any coins. To successfully achieve this, the Federal Trade Commission (FTC) reiterates the need to perform adequate research as a collector or investor.

However, one of the safest ways to guarantee the purchase of genuine gold, silver, or bullion US Mint coins is from a place that observes the different rules and regulations set by the relevant government and authorities. Such actions ensure that the tainting of the US Mint coin market does not affect the value of the coin sold in such organizations.

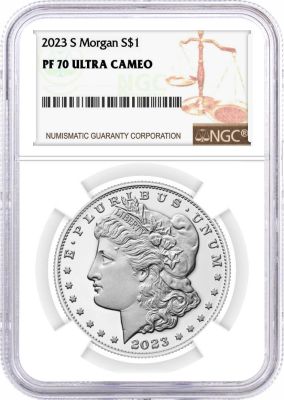

Therefore, the best US Mint coin to purchase is one that possesses historic and aesthetic value. Having such value ensures that professionals' grading passes the required tests and sell at the highest value possible. The grading of the coin before purchase ranges from 1 to 70; thus, the best purchase needs to have a reading closeness to 70. US coin mint marks that are near 70 can be purchased either for collection or investment purposes.

Such coins are viewed as US Mint commemorative coins. As such, they serve a special purpose of reminding relevant customers and potential buyers of the significance of cherishing their history. Coinage in the US is one of the most commemorated activities that ought to be taught to every generation. Also, US Mint palladium coins and US Mint platinum coins that pass the grader test by professionals can be purchased. Such aspects dictate the best coins for purchase and the safety of purchase.

US Mint bullion coins also make good purchases and as investment options. However, those seeking to purchase need to comprehend the basics, for instance, price, aesthetics, and reputation.

However, the difference between the basics varies from one person to another. The best Bullion coins to purchase need to surpass all the basic tests and each US Mint bullion coin has a different value depending on the quality (wear and tear) visible. In this case, silver US Mint coins are more expensive hence their huge sales across the US.

US Mint coins are a worthy investment choice because of the design (Eagle Design), especially for the Gold bullion coins. Additionally, the US Mint produces a range of commemorative coinage that transcends their intrinsic metal value. Whether collected by collectors or investors, gold US Mint coins have a high purchase and resale value due to their historic and aesthetic value.

What are the Best ways to Invest in Precious Metals?

The purchase of physical metals like bullion coins and bars is one of the best ways to invest in precious metals. You can make such purchases through the gold exchange-traded funds. As one of the safest ways to purchase metals, you can safely buy valuable metals like gold and silver only when you're sure that you're making relevant investments. This is why being informed and taking time to study the market is of great importance.

The gold exchange system helps collectors and investors create a portfolio that allows them to know the best prices and market conditions to purchase the metals. There is a disclaimer; however, since the above metals are volatile, they need to be handled with extreme care. Additionally, the gold exchange-traded funds allow collectors and investors to gain access to the derivatives market to study the different company stocks affecting the precious metals. Such are some of the ways to invest in precious metals.

The incorporation of hedging investments is considered a strategy that investors and collectors can invest in precious metals. Through the hedging investment, assets that lose value can be offset through insurance in case of loss or damage. Gold is a valuable precious metal and is thus affected by inflation (High and low).

One bar of gold is currently worth $1500 and requires strategies like hedging investments to rise in value. As a precious metal widely used for industrial purposes, silver also requires hedging to ensure it sells highly despite its wide prevalence. Such investments prove to be profitable when investing in precious metals.

How to invest in platinum bullion and coins?

One way to invest in platinum bullions and coins is to purchase goods from a trusted dealer with a previously good reputation. Platinum is considered a precious metal that has a wide variety of uses. It is mostly used in dental and jewelry work. Other uses include the mining output of gold. Through such, investing in gold plated metals from a trusted dealer proves a viable way to invest in platinum bullions and coins.

Another way to invest platinum bullions and coins is through partnerships with the automotive industry. For instance, electric cars use platinum, so people investing in such cars receive value for their money. Thus, it is safe to say that investing in platinum bullions and coins through the automotive industry is considered wise.