Gold IRAs: What They Are & Why They Are A Good Idea For Retirement

What Is A Gold IRA?

A Gold IRA, or Individual Retirement Account, is a specialized retirement investment that allows individuals to diversify their retirement savings by including physical gold and other precious metals in their portfolio. Unlike traditional IRAs that primarily hold stocks, bonds, and mutual funds, a Gold IRA allows investors to own tangible assets like gold bars, coins, and bullion. The primary purpose of a Gold IRA is to provide a hedge against economic uncertainty, inflation, and market volatility, as gold tends to retain its value and even appreciate over time. This can be particularly appealing to individuals seeking to safeguard their retirement savings and add an extra layer of security to their investment strategy. To establish a Gold IRA, individuals must work with a custodian or trustee specializing in precious metals to ensure compliance with IRS regulations and to manage the storage and handling of the physical gold within the account.

How Does A Gold IRA Work?

A Gold IRA works by allowing individuals to transfer or roll over a portion of their existing traditional IRA or 401(k) funds into a self-directed IRA, specifically tailored for holding precious metals. This self-directed IRA is typically established with the assistance of a specialized custodian or trustee who is well-versed in IRS regulations and the intricacies of gold investment. Once the Gold IRA is set up, the investor can select the type and amount of gold or other precious metals they wish to include in their portfolio. These physical assets are then purchased and stored in a secure, IRS-approved depository, ensuring they meet all regulatory requirements. The value of the precious metals in the Gold IRA will fluctuate with market conditions, and when the account holder reaches retirement age, they can choose to take distributions in the form of cash or take physical possession of the gold, subject to tax considerations.

Types of Gold IRAs

Types of Gold IRAs come in various forms, similar to traditional investment accounts. Investors have options such as:

- Traditional Gold IRAs: These retirement accounts are funded with pretax dollars, allowing contributions and earnings to grow tax-deferred. Taxes are paid upon withdrawal during retirement.

- Roth Gold IRAs: Contributions in a Roth gold IRA are made with after-tax funds, meaning there's no immediate tax benefit. Distributions during retirement are typically tax-free.

- SEP Gold IRAs: Similar to traditional SEP IRAs, SEP gold IRAs cater to employees of small businesses and self-employed individuals. Taxes are levied on withdrawals in retirement, not on contributions. The IRS has contribution limits, allowing individuals to save up to 25% of their compensation or a specified dollar amount, subject to annual adjustments. For example, the limit is $61,000 for 2022 and $66,000 for 2023.

These various Gold IRA options offer flexibility to suit individual financial circumstances and goals.

Why A Gold IRA Is A Good Idea

A Gold IRA can be a good idea for several reasons:

1. Diversification: Gold serves as a valuable diversification tool within a retirement portfolio. It tends to have a low correlation with traditional financial assets like stocks and bonds, which means it can help reduce overall portfolio risk. Better not to have all your eggs in one basket!

2. Inflation Hedge: Gold has historically acted as a hedge against inflation. When the value of currency declines due to inflation, the purchasing power of gold often remains relatively stable or even increases.

3. Economic Uncertainty: During times of economic turmoil, gold has shown its ability to retain value and provide a sense of stability in an investment portfolio. It can act as a safe haven asset when traditional markets are unpredictable.

4. Long-Term Value: Gold has maintained its value over centuries, and many investors see it as a long-term store of wealth. It can potentially appreciate in value over time, making it a suitable addition to a retirement portfolio.

5. Portfolio Protection: Gold can act as insurance against geopolitical events, currency devaluation, and unforeseen market downturns, helping protect one's retirement savings.

Can I Take Physical Possession Of The Gold In My IRA?

While it is possible to take physical possession of gold held in a Gold IRA, there are important considerations to keep in mind. Doing so can have tax consequences, potentially leading to income tax and early withdrawal penalties. The IRS has specific guidelines for gold storage in a Gold IRA, which generally requires IRS-approved custodians and depositories. Taking physical possession may result in the gold no longer being considered part of the IRA, affecting its tax-advantaged status. It's advisable to consult with a tax professional or financial advisor before deciding to take physical possession of gold from a Gold IRA, as the decision carries significant implications.

What Gold Company Is Best To Buy From?

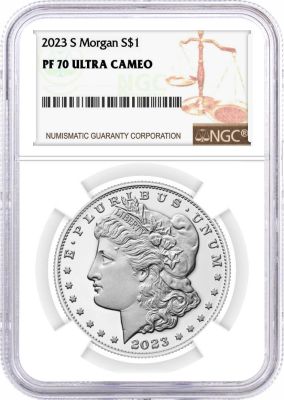

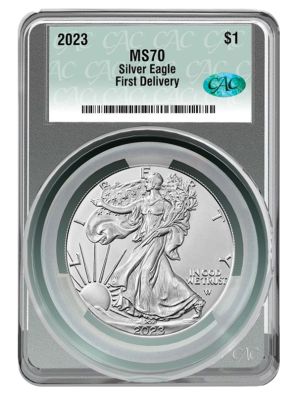

IPM is a great choice as your coin dealer. Our team of experienced, knowledgeable, and friendly account executives offers a low-pressure, personalized experience. We provide access to rare pieces that most dealers can't, all at the best prices with fast service. IPM has a proven strategy for precious metals investing, emphasizing risk minimization and privacy. With a 5-star rating on multiple platforms, affiliations with industry associations and the U.S. Mint, we're a trusted choice. Plus, we offer various communication options, including email, text, and chat. As one of the largest nationwide dealers of U.S. Mint coins and a leader in rare historic U.S. Gold and Silver, IPM's reputation speaks for itself.

To learn more check out other great articles at IPM including How Much Is An American Gold Eagle Worth, The Most Valuable US Coins In Circulation, and Should I Buy Circulated or Uncirculated Coins.