Is it a Good Idea to Buy Gold Coins or a Gold Bar?

Although the decision to invest in either gold coins or gold bars is often based on personal preferences, you should consider other factors such as tax implications, your investment strategy, and more importantly, what might give you a better deal when selling.

For centuries, gold has proven to be a stable, wise, and lucrative investment choice for both individuals and institutions. In addition to avoiding risks that come with relying on the unstable paper-based currency, investing in gold is a sure guarantee that you won't be affected much by inflation or currency devaluation. This is why smart investors turn to such precious metals to protect their wealth and diversify their portfolios.

You'll, however, have to choose between gold coins and gold bars or go for both. And as with any investment option, investing in gold coins or gold bars has its advantages and disadvantages.

It's important to note that there's no right or wrong answer when it comes to choosing between gold coins and gold bars. The decision to invest in either gold coins or gold bars should be generally influenced by your objective as an investor. After all, they're both lucrative investments and probably much better than paper currency.

You can choose gold bars as an investment option if you care less about the sentimental value of the gold and more concerned with the premiums of your investment. On the other hand, you can go for gold coins if you hold dear the cultural and historical value of these coins as well as their monetary value as an investment.

In this brief article, we'll take a look at how gold coins and gold bars compare as an investment vehicle. At the end of this read, you should be in a much better position to make a sound decision.

Definitions of Gold Coins and Gold Bars

To have a clear idea of which one to go for, it's essential to know exactly what you're dealing with.

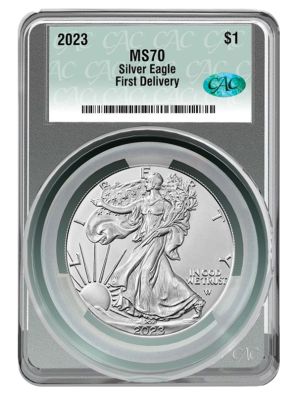

Gold Coins - These are precious gold metals designed in a coin format by a government-approved mint and are generally stamped with a legal tender face value. The sizes of gold coins may vary and range from small grams to kilos and even larger.

Gold Bars - These are precious gold metal bars that are designed both by government-approved mints and private gold mints. Unlike gold coins, gold bars do not have face values and may cost less in terms of an ounce and grams, though they're usually much larger and perhaps even purer than gold coins.

Comparing Gold Coins and Gold Bar as Investment Options

You should consider several factors when looking to choose between gold coins and gold bars as your investment options. Let's look at some of these factors.

Premiums

When it comes to precious metal trading, premiums typically refer to the additional costs that are charged above the gold spot price. These costs are charged to cover the extra costs of manufacturing packaging, delivery, insurance, and also to make the entire process competitive.

It doesn't matter whether you prefer gold coins or gold bars, every bullion investor will always buy gold above the spot price and this is what is referred to as the premium. With that in mind, you can decide to invest in gold bars if you want to keep the premiums at a minimum.

The idea here is that gold bars tend to attract much lower premiums than gold coins thanks to their larger unit size, which often leads to lower manufacturing costs. Here is a perfect example. It's a lot more cost-effective to buy a 1kg gold bar than to buy 10 100g gold coins.

Flexibility

As a bullion investor, flexibility often refers to the ease at which you can buy and sell your investment or products. While gold bars give you the best option if you want to preserve your wealth, gold coins offer the best value when selling. Of course, gold bars will offer the best value when buying but they don't give you the flexibility that you want when you want to sell.

As such, gold bars can be ideal for you as a long-term investment but are difficult to sell. On the other hand, gold coins give you the flexibility that you want in terms of buying and selling.

Tax Advantages

Needless to say, gold coins are still considered legal tender in the country and you aren't expected to pay any taxes by being in possession of them. Differently, gold bars may be subject to capital tax gains. This means that the gains you make from selling gold bars may attract capital tax gains.

Historic, Cultural, and Collectible Value

Gold coins are known to have more sentimental value than gold bars both historically and culturally. Simply put, gold coins can be more ideal for you than gold bars if you want to invest in something with a more historical and cultural value. Again, gold coins have more collectible value than gold bars.

Reliable Investment

While gold as a precious metal is often considered a reliable investment and much better than paper-based currency, it can be quite difficult to gauge the best value of gold coins. The idea here is that the prices of gold coins in your possession can fluctuate depending on several factors such as their rarity and mint state (condition).

On the other hand, gold bars are considered a far much reliable investment than gold coins because their value can be accurately determined. The idea here is that the value of gold bars is in the gold itself and that can only change based on the live spot prices of gold.

Size and Ease of Storage

As far as storage is concerned, you certainly want your investment to be as secure as possible both in monetary and physical terms.

Just like gold bars, gold coins vary in size. However, gold bars are much bigger in size and cannot be a perfect option if you're looking for a discreet form of investment. That being said, gold coins can be easily stored while gold bars are bulky and can only be stored in secured insured vaults.

Which is Better: Gold Coins or Gold Bars?

Although coins are easy to store and trade, gold bars can be deal options as long-term investments. Again, gold coins are flexible and easy to buy and sell than gold bars. As such, both gold coins and gold bars both have their advantages and it all comes down to your objectives and personal preferences as an investor.

But even with that, we believe that you should invest in both gold coins and gold bars. This is the best way to hedge your bets, spread your risks, and diversify your portfolio.