How to Prepare for a Recession: A Comprehensive Guide

In the post-pandemic world, economies around the globe are still trying to make a recovery. Some countries have already started to experience a recession, while others are preparing for a coming economic collapse. In the United States, there are growing fears that a recession may be on its way. You might hear people asking, “Are we going into a recession? Is the economy going to crash?”

Many economists say it is only a matter of time, so the best thing that you can do to protect yourself is to prepare for the worst. Fortunately, we’ve created this comprehensive guide so that you can take steps to prepare for a potential economic crash.

Before we begin, let’s answer some common questions that will help you better understand an economic recession and signs to look for:

- What is a recession? By definition, it is a significant and widespread downturn in economic activity that is prolonged over a period of time. Most economists consider two consecutive quarters of negative GDP to be a sign of a coming recession.

- How long do recessions last? Most recessions in the last 50 years have ranged from just two to 18 months long.

- Does a depression always follow a depression? No, the United States has faced more than 13 recessions since the Great Depression, and none of those were followed by financial depression.

- Is a recession coming? It’s tough to say for certain, so let’s take a look at some ways to prepare, just in case!

Step 1: Assess Your Financial Situation

If you’re wondering how to survive a recession, the very first thing that you should do is take a moment to assess where you are currently at with your personal finances. You can do so by taking stock of your assets and liabilities. Assets may include cash, investments, real estate, or savings accounts. Liabilities could be student loans, car loans, mortgages, or other money owed. Once you add these numbers up, you can calculate your net worth by subtracting your total liabilities from your assets. The higher your net worth, the better prepared you will be.

A negative net worth doesn’t necessarily mean that you will be in trouble if a recession occurs, but you should create a budget based on your income and expenses. You may have to consider cutting back on discretionary spending so that you can build your savings and increase your net worth before the recession hits.

Step 2: Reduce Your Debt

For those with a low or negative net worth, it’s especially important to reduce debt. The best way to do that is to prioritize them by paying off your high-interest debt first. Credit cards usually have the highest interest rates, and payment plans may be negotiable.

Another option is to consider consolidating your debt. This will allow you to pay off debts faster with lower interest payments. It also makes it easier to budget!

Finally, it’s critical that you don’t take on new debt before a US economic collapse. That means avoiding credit card debt, taking out a new loan, or buying a new house unless it’s an absolute necessity.

Step 3: Build an Emergency Fund

Even if you have a positive net worth, it never hurts to keep building your emergency fund if you want to recession-proof your finances. The amount of money you should have in your emergency fund will be dependent on your needs. You can calculate this by adding your monthly debt payments and basic costs of living. You’ll then want to multiply this monthly amount by three to six months.

To build your emergency fund to your desired amount, you should choose a low-risk account and make regular contributions. The most important part is to leave that money alone. If it’s an emergency fund, it should only be used for true financial emergencies like a recession period.

Step 4: Diversify Your Investments

Another option for how to prep for a recession is to make sure that your investments are diversified. A diversified portfolio can mitigate your financial risk of investing in the stock market during recession times.

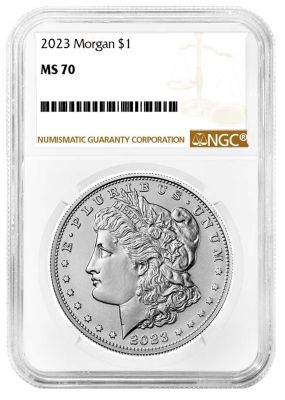

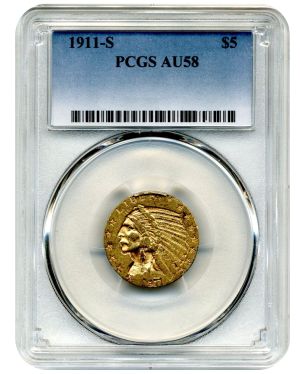

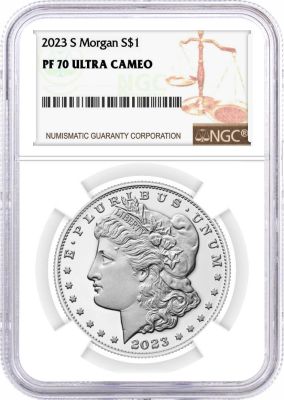

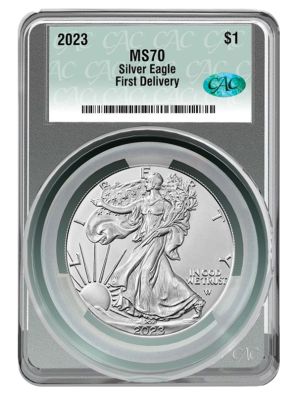

Want to know more about how to invest during a recession? We recommend adding some low-risk investments to balance out your high-risk stocks. Diversifying your portfolio with different asset classes also protects you from the fallout of a business collapse. You can do this by investing in different industries or companies that sell products in demand during recession times.

If you’re not sure how to effectively diversify your investments, we encourage you to seek professional advice. A financial advisor can help tell you more about how to prepare for an economic collapse based on your current investment situation.

Step 5: Protect Your Income and Assets

Another great way to prepare financially for war, recession, or another crisis is to take steps to protect both your income and your assets. You can start by reviewing your insurance coverage. If something happens to your house, car, or other valuable assets, will you have to pay for the loss out of pocket? Will you be able to afford to do so if a recession occurs? This may be a good time to consider purchasing additional insurance for optimal protection.

You can also protect your income and assets for your family by making sure that you have a will and power of attorney. If you already have one, you should make sure it is up-to-date and reflects your current assets. You can work with an attorney to find out more about how to protect money from recession times with a will. They can also ensure that you also have an updated estate plan that can apply during your life as well.

Step 6: Enhance Your Job Skills

Unfortunately, even if you prepare for a recession, the company you work for might not have. Recessions are hard on businesses of all sizes, and that can result in layoffs and job loss. Though you can’t guarantee you won’t lose your job, you can stay updated on industry trends and enhance your job skills for recession-proof jobs.

We also recommend that you take the time to pursue other professional development opportunities that may make you more attractive to employers. These opportunities are also great ways to meet more people, and you can continue to build your network at events. The more connections you have, the better off you will be if you lose your job.

Step 7: Evaluate Your Housing Situation

The last thing that you need to experience during a recession is a housing crisis. For that reason, you should take time to evaluate your current housing situation. Does it meet your needs? Are you paying extra for amenities or space that you don’t need? If so, you may want to consider renting out a room or downsizing. Renting out a room is an excellent way to increase your income, but it does come with risks.

It’s also wise to evaluate your current mortgage if you have one. You might be able to refinance for lower interest rates, which will make your monthly payments more affordable if a recession is coming.

Step 8: Prepare Your Business for a Recession

If you own your own business, you’ll want to take extra steps to protect it and your employees from financial fallout. Much like you would with your personal finances, you should also assess your business’ finances. How is your cash flow? Are you making enough money to pay off debts? If not, you may want to consider exploring your cost-saving measures. This might include switching to a different supplier, reducing waste, and using remote work when possible.

Another important way to prepare your business is to switch your focus to customer retention. Finding ways to ensure they continue to support you through economic downturns will help keep your company afloat. For client-based businesses, it’s important to diversify your list of regular clients and not put all of your eggs in one basket.

Step 9: Be Prepared for the Worst-Case Scenario

Finally, you should always prepare for the worst-case scenario because no one can definitively answer the question, “Is there a recession coming?” You can do this by planning out which assets can be liquidated into cash quickly if you need it. It’s also important to know and understand the options you have for debt relief. If you are unsure, it’s best to see professional advice on how to prepare for hyperinflation or a recession.

Conclusion

We know that hearing about recession vs. inflation and all of the other economic terms can be confusing and intimidating, but all hope is not lost, no matter the circumstances. By following these steps, you can better prepare your finances to not just survive a financial collapse, but you may even learn how to take advantage of a recession by investing in recession-proof industries. If you would like to find out more, we strongly recommend that you seek advice from a professional who can give you more specific instructions based on your financial situation.

If you’re interested in reading more about rare US coins, check out some of our other great posts including, ‘Investing in Gold Coins vs Bars’, ‘Gold Spot Price' and ‘Widow's Mite’.