Why You Can’t Afford Not To Invest In Precious Metals

Why You Can’t Afford Not To Invest In Precious Metals

Precious metals have long held a distinguished place in the world of investment, and for good reason. They offer a unique set of qualities that make them an excellent choice for diversifying an investment portfolio. In an era of economic uncertainty, fluctuating markets, and evolving financial landscapes, precious metals such as gold, silver, platinum, and palladium provide a reliable counterbalance to traditional assets like stocks and bonds. Their historical track record, intrinsic value, and the ability to hedge against various economic and geopolitical risks make them a smart addition to any diversified investment strategy. In this article, we'll delve into why precious metals stand out as a compelling option for diversification and why you can’t afford not to invest in precious metals.

Economic Uncertainty

Diversifying in precious metals, such as gold and silver, can serve as a crucial safety net in the event of an economic collapse. Precious metals have a proven track record as hedges against economic turmoil and financial crises. When traditional assets like stocks and currencies lose value due to inflation, deflation, or market crashes, precious metals often move in the opposite direction, preserving their intrinsic worth and even appreciating in value. In times of uncertainty, people turn to these tangible assets as a store of value and a reliable form of wealth protection. Take for example. the outbreak of the COVID-19 pandemic. The resulting economic uncertainty prompted a surge in demand for precious metals, particularly gold and silver. Investors turned to these metals as a hedge against the economic fallout and currency devaluation risks associated with massive stimulus measures. By including precious metals in your investment portfolio, you can shield yourself from the ravages of economic collapse, ensuring that you have a resilient asset that retains its value when the dollar and other investments falter.

International Value

Precious metals like gold and silver have earned their reputation as the best international currency due to their universal acceptance and true value. It transcends geopolitical boundaries and economic systems, acting as a store of value historically. Its scarcity, durability, and inherent worth make it a reliable means of exchange, making it a preferred asset for international trade and investment. This is why gold was used as an international currency is the Gold Standard, during the 19th and 20th centuries. Under the Gold Standard, many countries tied the value of their national currencies directly to a specific quantity of gold. This ensured that the currency had a stable and fixed exchange rate in terms of gold.

Today, central banks and governments still hold substantial gold reserves as a means of diversification and financial security in the international monetary system. However the safest investment as international currency is still gold and other precious metals themselves!

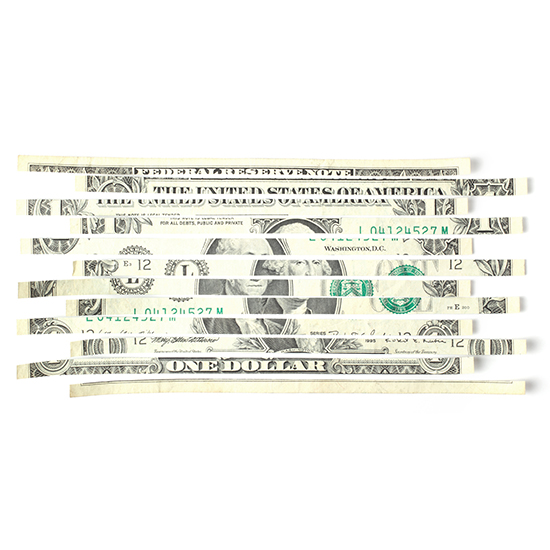

Dollar Devaluation

investing in precious metals will also help to safeguard against dollar devaluation. As paper currencies, like the US dollar, can erode in value due to factors like inflation and economic instability, precious metals retain their value. By holding a portion of your investments in precious metals, you create a reliable hedge against potential currency devaluation. In times of currency depreciation, your precious metal holdings can appreciate in value, helping to protect your wealth and maintain your purchasing power, regardless of broader economic fluctuations.

Protecting Your Retirement

Investing in precious metals for your retirement fund can be a massive benefit in the long term. Precious Metals, like gold, silver, platinum, and palladium, among others, provide a hedge against inflation, a critical concern for retirees facing rising living costs. Unlike the dollar and other paper assets, precious metals maintain their intrinsic value over time, making them a reliable store of wealth. They also tend to perform well during times of economic uncertainty and market volatility, offering stability to retirement portfolios. Diversifying your retirement investments with precious metals can also reduce overall portfolio risk by providing a counterbalance to traditional assets like stocks and bonds. Precious metals are highly liquid, allowing you to convert them to cash when needed easily. By including precious metals in your retirement strategy, you add a layer of security that can help safeguard your financial future and provide peace of mind during your golden years.

Security

Throughout history, precious metals have played a pivotal role as both a store of value and a form of currency. Their enduring appeal lies in their unique properties: scarcity, durability, and intrinsic value. These metals are relatively rare in nature, making them inherently valuable. Their durability ensures that they do not corrode or deteriorate over time, preserving their worth across generations. Moreover, their intrinsic value, derived from their industrial uses and aesthetic appeal, reinforces their status as reliable assets. These characteristics have made precious metals a preferred choice for trade and wealth preservation for thousands of years, transcending borders and civilizations, and continue to underpin their significance in today's global economy. Whether as a means of exchange, a hedge against economic uncertainties, or a store of wealth, precious metals remain a testament to the enduring value of tangible assets in an ever-changing financial landscape.

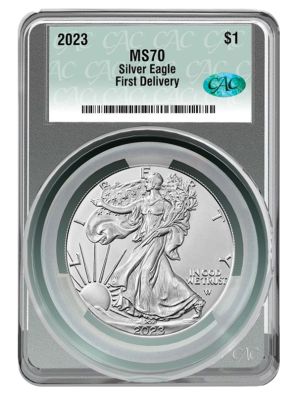

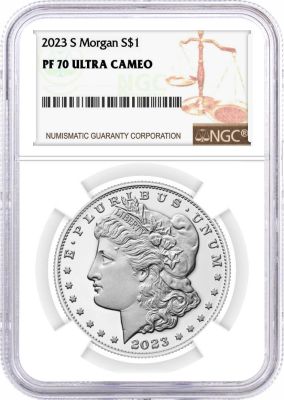

International Precious Metals is one of the best online coin dealers available, and has been at the forefront of numismatics for nearly 20 years now. We faithfully serve both the online and offline coin community. To start investing, check out our full collection here! To learn more check out other great articles at IPM including How Much Is An American Gold Eagle Worth, The Most Valuable US Coins In Circulation, and Should I Buy Circulated or Uncirculated Coins.