Precious Metals IRAs

SET UP YOUR PRECIOUS METALS IRA

IN MINUTES!

What should I put in my precious metals IRA?

Click here to shop for IRA eligible products. Certain products must meet minimum standards to be eligible to put into a precious metals ira. IPM offers our clients a unique strategy to get extra value from your precious metals portfolio. By targeting certain areas of the precious metals markets, we have devised a strategy to return additional value in the event of cash out. Ask one of our ira specialists for more information, or email us at iras@preciousmetals.com

A Precious Metals IRA allows for diversification.

Diversification helps smoothout the volatility within investment holdings, with the goal being more stable, reliable returns over time. Simply hedging among different stock investments over time isn’t enough, as millions of Americans learned when their retirement investments evaporated as a result of the financial and economic crises beginning in 2008. Though we all hope for a swift and sustained recovery, a prudent investor must keep in mind the remaining threats to paper assets: massive government debt at home and abroad, inflation, quantitative easing, the weakening U.S. dollar and geopolitical tensions among others.

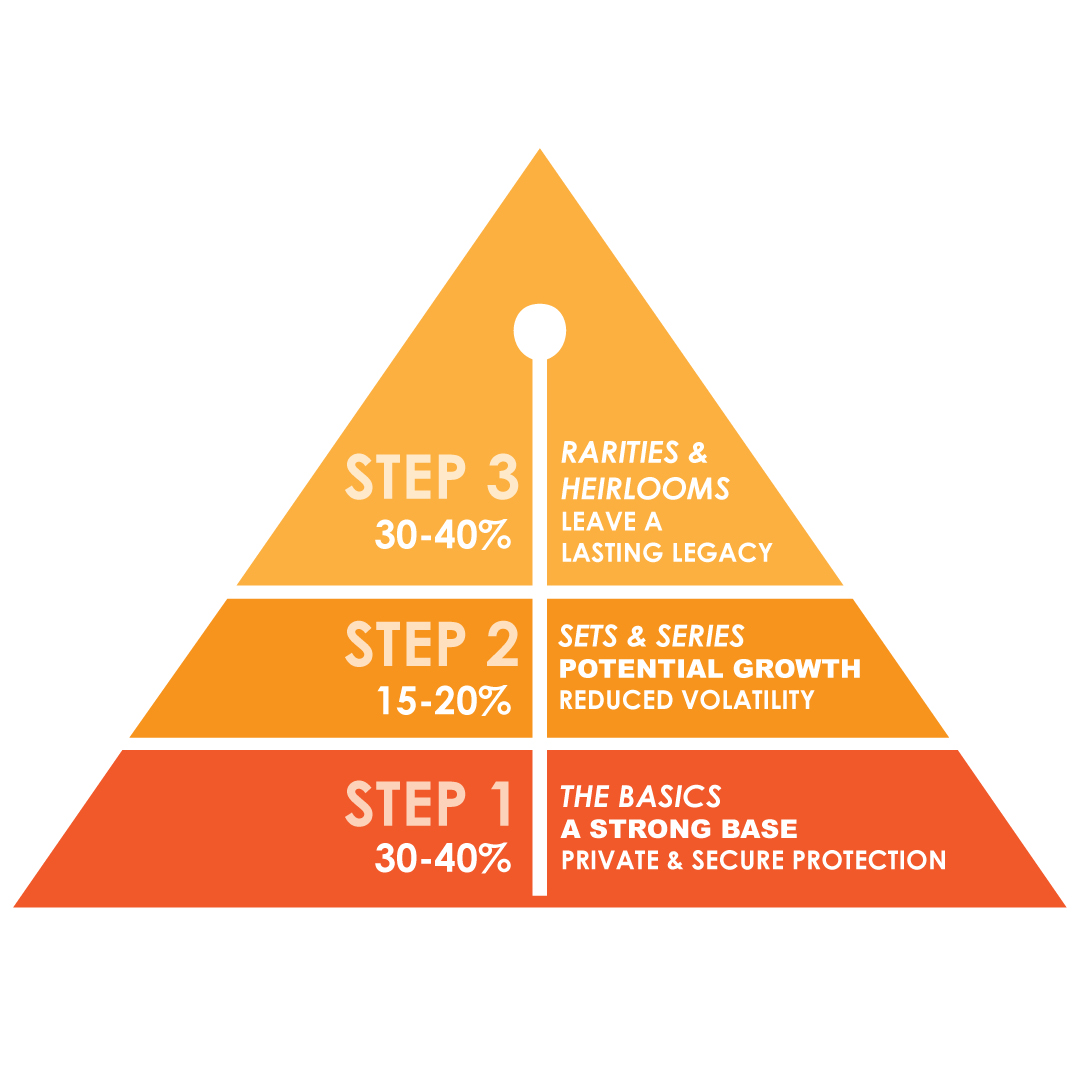

To diversify within the tangible assets category, distribution across three investment sectors is advised. This distribution is the most profitable in the long term as each asset class comes with its own financial benefits. Different coin types can serve short, medium and long-term holding strategies to maximize security.

Beyond diversity, a precious metals IRA provides opportunity.

In light of the recent crises, precious metals have performed remarkably well. Experts predict continued strength in the years to come. At IPM, we help our clients to focus on short, medium, and long term strategies inside of their metals portfolios so that, regardless of what happens, you’re prepared.

A Precious Metals IRA provides safety

Precious metals are the safe haven asset of choice for individuals, institutions and governments alike. The attributes that make precious metals a safe investment naturally extend to a Precious Metals IRA, in which real, physical metals are held in your account. Unlike paper assets, which may become devalued in a future crisis, the value of precious metals can never fall to zero. Nothing brings peace of mind like knowing your retirement assets are stored in a fortified bank vault. We offer full depository services through our affiliated partner.

A Precious Metals IRA offers a level of control not found in any other retirement solution

A precious metals IRA is a self-directed IRA. It allows you to make every decision about your account assets, allocation and redistribution, while also giving you important tax advantages. When taking a distribution you can choose to take physical delivery of your metals or to sell and accept cash funds. And the small annual fees on this type of account are often lower than those of other accounts.

IPM offers the easiest setup, on and off-shore depository solutions, and IRA specialists to help you through the process.

Give us a call at 800-781-2090 and ask for an IRA specialist.

Questions?

Give one of our friendly executives a call

at 1-800-781-2090!

Precious Metals Frequently Asked Questions (FAQ)

-

Question 1: How do I get started?

Talk to your IPM representative today for more information about getting started with a precious metals IRA. You will have the opportunity to choose a trust company whose services best match your needs. You’ll receive an information package provided by the trust company that includes application paperwork needed to establish an account. Your representative will help you to choose one or more precious metal asset that represents the best opportunity for your future. Then, after completing the few simple steps, you will be enjoying the freedom, flexibility and security of a self-directed precious metals IRA. We at IPM are eager to help you plan for your future, and look forward to assisting with an IRA that you choose to match your needs!

-

Question 2: How does a precious metals IRA work?

You may fund your precious metals IRA with a variety of different gold, silver and platinum coins. Most people choose American Eagle coins from the United States Mint. You enjoy the flexibility to include IPM recommended coins to your IRA holdings, which allows you to enjoy many of the benefits of our unique investment strategies. Your coins are held by a third-party trust company specializing in self-directed retirement funds, which is fully licensed and regulated by federal and state agencies. IPM can help you to set up an account with one of our recommended trust service companies. You can then fund your account and direct the trust company to acquire exactly the metals you want from IPM. Your coins are then shipped to a secure, fully insured depository that will hold your coins for the full term of your IRA. We recommend International Depository Services.

-

Question 3: What are the advantages of a precious metals IRA?

An Individual Retirement Account gives you a tax-advantaged way to save for the future. By following the relatively simple guidelines required by IRA plans, you can enjoy tax-deductible contributions, tax-free withdrawls, or other benefits not available with traditional savings and investment strategies. The fact that precious metal coins are sold in both bullion and collector markets gives them two distinct values, allowing you the possibility of further, unique tax advantages. And since a precious metals IRA is a self-directed investment, you have complete control to change or re-direct the assets in the fund, unlike many paper-asset based IRA strategies, where your money is under the direction of nameless, faceless fund managers.

-

Question 4: What are the limitations of a precious metals IRA?

Currently, an individual may contribute $4,000 per year to an IRA account. Married couples may double this amount, whether or not the spouse meets the compensation requirement. The contribution limit will rise to $5,000 in 2008. Those over fifty may contribute somewhat more. There are various income limits associated with IRAs – your IPM representative can tell you more. Many individuals start their precious metals IRA by rolling over funds from another IRA or retirement fund, which allows them to immediately shift a substantial portion of their savings into precious metals assets.

Funding & Withdrawals

-

Question 5: What forms of precious metals may I add to my IRA?

Originally, only American Eagle gold and silver coins and proof issues were allowed for investment in a precious metals IRA. In 1998, new laws allowed the American Eagle Platinum coin and proof to be included, as well as a select variety of gold, silver, platinum and palladium bullion products that meet certain standards. American Eagle coins remain the most popular way to contribute, however, and since IPM specializes in targeting low mintage issues of Eagle coins, your representative’s recommendations are likely to focus on them. That said, your precious metals IRA is all about freedom of choice, and your IPM representative will help you to add any qualifying precious metal asset to our account that you desire.

-

Question 6: How do I fund my account?

In selecting precious metals assets to add to your account, you work with your IPM representative the same way you would to acquire any other precious metals holding. You decide when and what coins to acquire – you are never obligated to fund your account at any time. Once you have made a decision, you then fund your trust account with cash, transfer, or rollover assets, and direct the trust company to acquire the metals from IPM on the terms you have established with your account representative. Unfortunately, law does not permit you to fund your account with coins that you already own. However, IPM can help you liquidate your current holdings to be reinvested into IRA metals holdings.

-

Question 7: What happens when I'm ready to draw assets from my precious metals IRA?

Your options for taking a distribution of IRA assets will depend upon the type of IRA account you have selected. You will have the option to allow IPM to liquidate your precious metals assets, or to take physical delivery of your coins. Either way, you have the opportunity to benefit from both the bullion value of the coins, plus any numismatic appreciation that may have accrued.

-

Question 8: What if my coins peak in value before I'm eligible to take a distribution?

Precious metals IRAs are self-directed funds. You can instruct your trust company to make changes that will maximize your returns by trading one asset for another. Your IPM representative will track the value of your holdings just as he or she would with any other acquisition, and inform you when changes could be advantageous (please note that it is your responsibility to consider any possible tax consequences when reallocating IRA assets).

Eligibility

-

Question 9: Am I eligible to open a precious metals IRA?

To be eligible for any Individual Retirement Account, you must receive some form of compensation, such as from a job, self employment, or alimony. Presently, income from investments, pensions or annuities does not qualify. Since the amount of compensation required to fully fund an IRA account is relatively modest, almost everyone can participate in some form of IRA. To contribute to a traditional IRA, you may not be older than 70 1⁄2 years. You may contribute to a Roth IRA at any age, however. There are other rules and guidelines that will influence your choice of IRA plan. Your representative can provide you with additional information that can help you to decide what type of IRA is best for you.

Fees and Administration

-

Question 10: What fees will I have to pay?

Setup fees will vary among trust companies, but around $100 for your first year is a good number to plan for. Subsequent annual fees will be based on the asset value of your IRA holdings and range from around $50 to around $500 for the largest accounts. You may now have an IRA account with your bank or other financial institution that does not charge an annual fee. That is because fees come as a built in deduction to the interest rate that such accounts pay. Trust companies receive no commission from any of your investment actions, so these separate fees are necessary to cover the cost of maintaining your account. IPM makes no commission on fees paid to your trust company. The costs associated with your account are transparent and on the table – rather than being hidden, as in a so-called free account.

-

Question 11: Will it be easy to manage my IRA account?

Self-directed IRA accounts give you unmatched flexibility and a high level of convenience, as well. You can direct changes in your fund by telephone or fax if you choose. You will regularly receive easy-to-read statements of your account that include an estimated market valuation of your assets. These estimates will be based on the bullion value of your coins rather than any potential numismatic value, which will serve to hold down certain fees (see following section on fees). Necessary IRS reporting will be handled promptly by your trust service.

Important Things To Note

All investments involve risk; projections and predictions of future performance of any investment by IPM do not imply a guarantee. Photographic representations of coins shown in this publication are often enlarged to show detail, and may be digitally enhanced or manipulated. Unless a specific grade or other condition is specified, modern issue coins portrayed in this publication are guaranteed to be delivered in brilliant uncirculated condition. IPM is not affiliated with the U.S. Mint or any government agency. IPM cannot be held responsible for typographical errors in price.