Why Is Gold Going Up

Why Is Gold Going Up

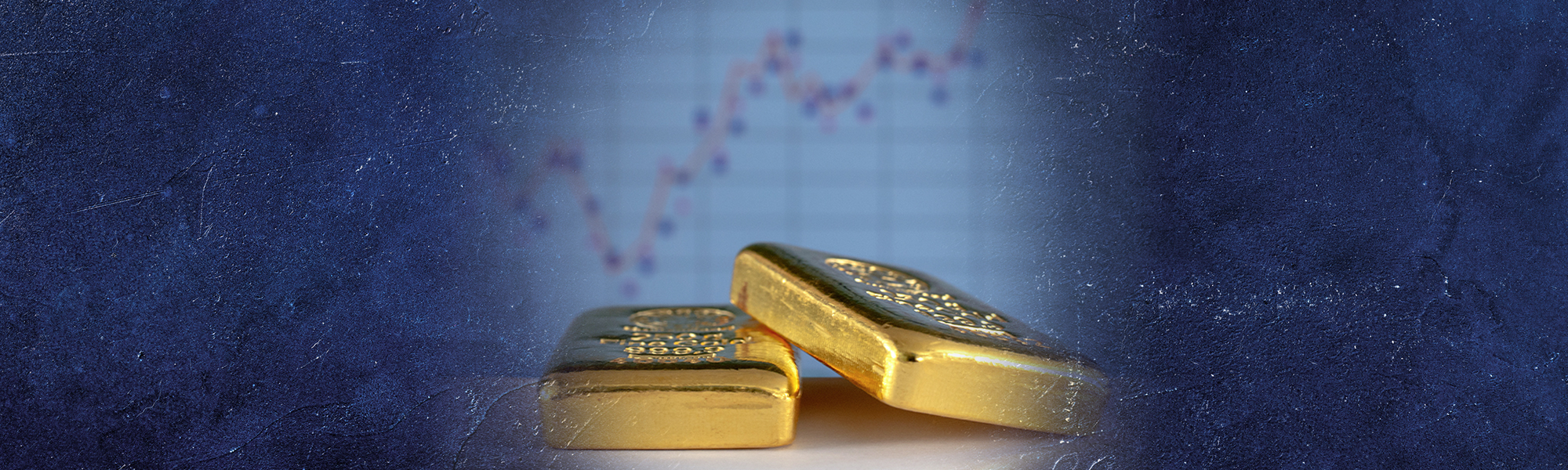

For centuries, Gold has always been used as a "safe haven" asset in times of uncertainties, helping to store value and wealth. This precious metal is less volatile than other investment vehicles, like stocks. It can be stored, retrieved, and exchanged at a later time without deteriorating in value. It is these innate characteristics that make gold a highly sought after metal by most investors. As fiat currencies undergo upheavals and market uncertainties, gold will continue to be a preferred investment option for many people.

Since 2019 gold's value has been increasing steadily. In 2020 alone, the annual percentage price change for this yellow metal has jumped up by over 25%, outperforming most global stock market indexes. As of December 22, 2020, the price of gold was $1,870.30 per ounce. Pundits maintain that the resurgent gold bulls are likely to gather more momentum, pushing the market indexes upwards. This raises the question: why is gold going up?

Why the Price of Gold Moves Up And Down

Typically, the price of gold is moved by a combination of factors including supply, demand, investor's behaviors, perceptions, and psychology. While these seem pretty straightforward, most times, these factors work in a counterintuitive manner, which is largely unknown or overlooked. Let's look at some of the common factors that influence the price of gold bullions.

- Federal Reserve's Monetary Policy

This is perhaps one of the biggest drivers for the changes in gold prices. The Federal Reserve sets the interest rates that drive investors to look for assets that are likely to create some opportunity costs.

According to financial experts, gold is inversely correlated with interest rates. This means that the price of gold will shift upwards with decreasing interest rates. When the rates rise, investors rush to buy other assets that yield returns and drop gold which doesn't carry any such returns.

- 2. Value of the US Dollar

Gold is a dollar-denominated metal. Its price shifts negatively to the US dollar. When the US dollar is strong, the price of gold tends to go down while increasing when the dollar is weak. Similarly, when the dollar is weak, investors tend to hedge their investments by increasing their gold investment allocation.

- 3. Supply and demand

Gold is an essential raw material for jewelry and electronics manufacturing. When there is a surge in demand for the yellow metal, its price is likely to shift upwards. Similarly, when there is a constrained supply, and a stagnant demand, gold prices are also likely to go up. Conversely, when there is an oversupply of gold, the prices for the yellow metal are likely to tank.

- Inflation

Investors look at inflation as a sign of economic growth and expansion. If the economy is growing, the Federal Reserve tends to increase the supply and circulation of fiat currencies, which dilutes the dollar value for each note in circulation. This makes it more expensive to buy gold. Interestingly, during inflation, the demand for gold also skyrockets as more investors rush to buy this metal, further pushing the prices upwards.

- Uncertainty

Gold prices are affected by investor psychology. This means that, during times of uncertainties such as the recent coronavirus pandemic, looming recessions, and political uncertainty/instability, the prices of gold are likely to move upwards as investors look for safe-haven investment assets. However, since uncertainties are plainly psychology-based, the behavior for gold prices can vary from one event to another.

- Economic Data

This is the least influential factor to affect gold prices. However, from past price movement trends, gold prices tend to fall when the US economy is strong. Ideally, this happens when there is job growth, manufacturing expansion, low unemployment, and a GDP growth of more than 2%.

There you have it! These are some of the factors that typically make gold prices to shift. But why in specific has gold prices been going up in 2020. Well, let's explore some of these factors to help you make an informed investment decision.

Why Is Gold Going Up: Specific Trends Causing A Bullish Gold Market

Here are some of the market trends that have kept the gold market moving up steadily.

- Coronavirus (COVID-19) Pandemic

Since the emergence of COVID-19, global economies and money markets have been facing immense uncertainties. These uncertainties drove investors to buy into gold to hedge their investments. This has significantly pushed old prices upwards throughout 2020.

Currently, there is a new bullish price shift as European countries reported a surge in COVID19 cases and the possibility of a new coronavirus strain. This is likely to jack up gold prices as we move into 2021 as investors seek cover from COVID-19's global economic toll.

- China-US trade wars

Since 2018, the US and China have been experiencing a rise in tension due to ongoing trade wars. The tensions intensified when the US forced the closure of China's consulate in Houston, which forced a reciprocal closure of the US consulate in Chengdu. These trade uncertainties between the two countries have significantly led investors to buy safer haven assets such as gold, pushing its prices upwards.

- Lower Interest Rates

As the coronavirus pandemic slammed the economy in March, the Federal Reserve slashed the lending and interest rates to historic lows to keep the economy afloat. This has significantly pushed gold prices upwards as investors rush to buy gold to gain some opportunity cost after selling at a later date.

- Central Bank Stimulus

The stimulus program announced by the Federal Government to protect the American people and businesses against the ravaging effects of the coronavirus pandemic supercharged the existing momentum for Gold prices. Gold tends to benefit from government-backed stimulus measures as it raises the prospects of inflation. Cautious investors rush to buy gold bullions to hedge their investments and store their wealth. Consequently, this rising demand pushes the gold prices upwards as recently witnessed.

- Recent Situation In The US

The US presidential elections play a critical role in shaping the global economy. The pre and post-election periods have seen widespread stock volatility. This has pushed cautious investors to buy into traditional safe havens such as gold. The underlying macroeconomic conditions and a growing mishmash of uncertainties among investors during this period have significantly driven gold prices.

- Media Coverage

Since 2018, gold has been receiving tremendous media coverage. In 2020, there we commentaries of a possibility of gold hitting a new high. This alone has influenced investor's phycology and perception, leading to more interest in this yellow metal. This has pushed gold's demand upwards, translating to a positive shift in prices.

Why Now Is the Time to Invest?

Gold continues to be a popular investment for ages. It has a long-standing value that has made it an attractive and safe investment. With growing volatility on Wall Street, gold presents a perfect investment option for people looking to protect their wealth. Typically, financial advisors recommend a gold allocation of 1% to 5% of an individuals' overall portfolio.

While there is no good time to buy gold, the current bullish gold market suggests high potential returns ahead. It, therefore, makes sense for every investor to have some gold investment in their portfolio. Investors looking for long-term investment vehicles should consider buying traditional coins and bullions that are easy to buy, sell, and transfer to heirs over time.