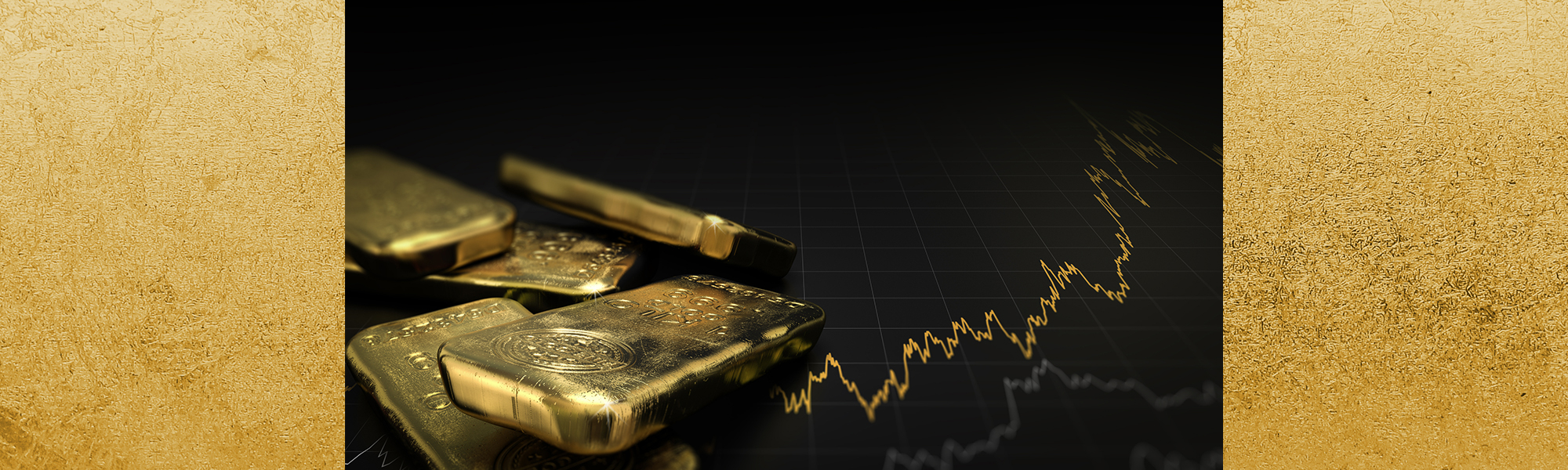

Why Gold is a Safe Haven Investment

Gold has always been a compelling financial option– for decades, even centuries, investors have all been attracted to gold bullion as a safe haven investment. The expectation from many investors it that gold prices stay stable or even increase during times of market turmoil, and it turns out that they are right.

Gold – is it a proven safe haven investment?

The negative correlation between gold prices and US Stock market performance is the main reason why gold is used to hedge against market downturns. This can be proven by taking a look at the price relationship between Gold and the S&P 500 during the most recent three financial crises.

What exactly is a safe haven?

First of all, it is important to realize that a “safe haven” investment is slightly different from a hedge – the definition of a safe haven investment is a position that has no correlation or is negatively correlated with another asset or market in times of turmoil. This means that the purpose of maintaining a gold position is to limit losses during times of extreme market stress and/or volatility. (And of course, we know that in the Great Recession of 2008, gold prices went down along with everything else at first).

Relationship between S&P 500 and Gold during financial crises:

For context, let’s take a few steps back and take a look at the relationship between Gold prices and the S&P 500 during three of the most recent financial downturns. [caption id="attachment_787" align="alignnone" width="721"] Chart from: stockcharts.com[/caption]

Chart from: stockcharts.com[/caption]

2008 – 2009 Financial Crisis (Gold vs. S&P 500)

The most recent financial crisis was in 2008-2009, as shown in the chart above, which shows the relationship between Gold and S&P 500 prices. The beginning of the downturn is marked by the collapse of Lehman Brothers on September 2008, where the S&P 500 had a high point of $1,450. Over the next year, the S&P 500 steadily dropped until it hit a low of nearly $685 in March 2009 – a drop of over 50%. On the other hand, Gold prices steadily increased during that time frame, jumping from a low of $890 to nearly $1000, an increase of almost 11%. During this time period, gold prices increased when the S&P 500 price dropped, demonstrating the inverse price relationship and reinforcing its status as a safe haven security. [caption id="attachment_788" align="alignnone" width="722"] Chart from: stockcharts.com[/caption]

Chart from: stockcharts.com[/caption]

Dot Com Crash (Gold vs. S&P 500)

An even earlier financial crisis was burst of the Dot Com bubble 2000 after years of sustained growth in the technology sector. The graph above demonstrates again that gold proves to be an excellent hedge in times of dire financial circumstances – gold prices increased when the S&P 500 price tanked. The S&P 500 dropped from a high of $1,133 on September 1st, 2001 to a low of $975 by middle of September whereas Gold prices rose from $274 to $292 in the same window of time. In other words, the S&P 500 dropped nearly 14% when Gold prices rose over 6% in under a month. [caption id="attachment_789" align="alignnone" width="714"] Chart from: stockcharts.com[/caption]

Chart from: stockcharts.com[/caption]

Early 1990’s Recession (Gold vs. S&P 500)

Finally, the early 1990’s recession was an 8-month bear market spanning from July 1990 through to March 1991. In this scenario, the S&P 500 slid from a price of almost $370 in July 1990 to $300 in October 1990, the worst point of the recession. Gold prices again demonstrated its inverse relationship with the US stock market, as prices jumped from $365 an ounce to over $405 an ounce in the same time period, marking a nearly 19% decrease in S&P 500 prices versus a 10.9% increase in gold prices. In fact, gold peaked at an extremely high $425, representing a 15% increase of gold prices.

Gold has a proven track record

Based off of these three examples, it becomes clear that Gold is an excellent safe haven investment. During times of economic downturn, gold has repeatedly demonstrated its inverse price relationship with that of the S&P 500. Past performance indicates that investors tend to migrate towards gold when financial crisis began – meaning that the gold price jump is also a result of increased demand – especially valuable if you already have a gold position in your portfolio as a “worst case” scenario type of hedge.

Looming financial crisis?

In other words, it is probably a good idea to preemptively buy positions in gold if you suspect that a financial crisis is inbound to minimize any losses – much like you would purchase an insurance policy. After all, you don’t buy insurance on an accident after its already occurred. Nothing in the stock market is guaranteed, but past data strongly shows us that gold is a pretty solid and safe haven option to own – especially if you have a position before a financial downturn even begins. And, as the market becomes more and more bloated, along with many global threats and crises looming around us, gold continues to stand as a safe haven for our hard earned money.