Why Buying Precious Metals Will Keep You Safe From A Stock Market Crash

Why Buying Precious Metals Will Keep You Safe From A Stock Market Crash

If you look closely at the most successful investors' portfolio, you'll notice one thing common among all of them; they all have invested in precious metals like gold and silver. The reason why is because history has shown that, no matter the economy or the state of the world, precious metals hold their value and offer a hedge against any economic crisis. However, many new investors have whether precious metals will keep them safe and hold their value during a stock market crash. The answer to that question is a definite yes, as we'll see below.

History Says That, Yes, Precious Metals Hold their Value Even During A Crash

One of the easiest ways to find out if precious metals hold their value during a crash is to look back and see what happened during previous times of economic collapse. Thankfully, history allows an investor to look at things with 20/20 vision, so to speak, and see things free of any bias. It says about precious metals, especially gold, that they do indeed retain their value and, in many cases, even increase in value.

For example, during the crash of 1976, gold prices actually increased by a whopping 53.8%, while silver rose by a healthy 15.2%. Experts agree those are some very healthy increases. During the crash of 2007, gold rose again by 25.5%, while silver rose 1.1%. Indeed, during the eight largest crashes since the 1970s, gold increased in value most of the time.

Gold Prices Increase During Both Long and Short-Lived Stock Market Crashes

History shows that no matter the length of the crash, gold prices almost always increase. Again, during one of the worst in the last 50 years, gold prices rose the most! Amazingly, even during the worst crash, from march 27, 2000 through October 9, 2002, gold still rose in value by 12.4%! That's a powerful indicator indeed that precious metals keep you safe from a stock market crash. Even during the worst crash in the last 50+ years, the value of gold still increased. For many investors, it was the single investment that held its value.

Between the 1970 and 1980s, Gold Increased in Value by 2300%

While gold hasn't risen tremendously fast in the last few years, its value has steadily increased. During the 1970s and 1980s, though, the increase was tremendous. If you had invested in gold at that time, you would have seen your investment increase more than 20-fold! That's a better return than practically any other investment, bar none, and an excellent example of why investing in precious metals like gold is a smart financial move.

Gold and the Stock Market Are Inversely Correlated

Another fact that history provides about investing in gold and other precious metals is that they do the exact opposite and go up when the stock market goes down. While this doesn't appear to make sense on the surface, it does if you look more closely at economic factors.

For example, during times of economic growth and stability, stocks benefit and increase in value, which makes perfect sense. Investors are calm and confident, and the purchasing of stocks increases significantly. However, during times of economic hardship and crashes, investors are much more fearful, so they seek out gold and other precious metals as a safe haven. It's a correlation that's been seen time and time again through history.

Historically, Gold Has Outperformed Cash and Money Market Funds

Looking back over the last 60 years or so, it's easy to see the performance of investments like precious metals, cash, and money market funds. The data tells us that, during times of economic crisis, gold has almost always performed better than money market funds. Also, it performs significantly better than cash sitting in your savings account. Incredibly, gold has even performed better than real estate in the majority of cases, a potent indicator of its long-term investment value.

When Other Assets Fall, Gold Almost Always Rises

Your main goal as an investor is, in basic terms, to purchase an asset at a low price and sell it at a higher price. The problem is, during a stock market crash, practically all assets fall in value. However, gold and other precious metals nearly always rise, making them a better option than many other investments.

Top Investors and Financial Experts Are Advising to Buy Gold and Other Precious Metals Right Now

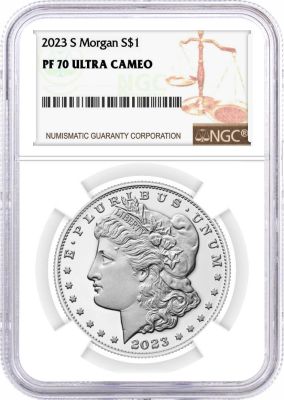

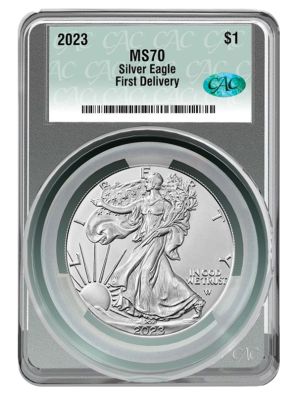

Currently, with the Coronavirus pandemic causing economic panic, financial experts recommend that investors purchase gold and other precious metals. They include Dr. Mark Skousen, Ph.D., an economist and Presidential Fellow at Chapman University. Dr. Skousen began recommending gold in December of 2019, and the pandemic started, especially gold bullion and coins.

Hilary Kramer, the host of a national radio program called "Millionaire Maker," has been advising the same. She says that using U.S. dollars to purchase gold and silver bullion and coins is a brilliant financial move. Indeed, Kramer says that "Motivated sellers plus an absence of buyers drives prices down." That's the perfect storm, if you will, for investors who wish to increase their stockpile of precious metals.

Most expert investors prefer a mixture of precious metals, including gold, silver, palladium, and platinum. Some recommend that, during a financial crisis, you sell off some of your bullion and coins to meet any financial obligations you might have. Then, as soon as possible, they advise replenishing your supply to protect yourself again when the next crisis arrives.

In Closing

If history tells us anything, it's this; precious metals are a safe financial haven during times of economic crisis. They perform better, keep their value, and, in some cases, skyrocket in value during those times. In short, buying precise metals will keep you safe from a stock market crash.

If you have questions about what you've read today, need advice, or would like to start investing in precious metal coins and bullion, we're here to help. Leave a message in the space below, and a friendly representative from International Precious Metals will contact you within 24 hours.