Everything You Need to Know About the Bank of New York Hoard

The Bank of New York Hoard

Investors and collectors often dream of finding hidden gems and rare treasure. Whether it is traveling to magical places, tropical islands, or visiting five-star hotels, there are numerous things that you can do after finding treasure. The Bank of New York Hoard story follows the discovery of a hidden treasure of over 50 years from the bank's Wall Street Bank Vault in 1788.

It is believed that the treasure chest contained approximately 16,000 vintage Morgan Dollars still in pristine mint condition. Unfortunately, the coins were forgotten until they were re-discovered in the year 1856. They were immediately placed in cotton bags to determine the next course of action. In 1926, the bank gave them out as souvenirs and gifts.

The remaining coins (approximately 1,641 coins) were examined by the American Numismatic Society and handed out as donations. The discovery led to increased curiosity among other banks, collectors, and investors. Here is the interesting part; the preserved treasure has been untouched for the last half of the century. This means that the discovered pieces have increased in value especially for collectors and investors. Therefore, the coins are considered unique items that can be profitable for investors and collectors.

How The Discovery Was Made

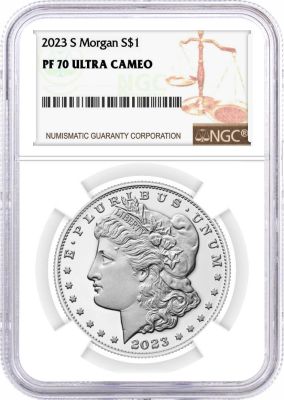

The Morgan Hoard Findings can be considered a secret treasure because 16 canvas bags were wire-sealed with lead clamps and torn ID tags. The coins were placed in bags that were imprinted with designations and stamps from the U.S. Mint coins. Coins that were collected, and encapsulated with the special NGC certification label increased their value.

It was recommended that investors and collectors purchase the coins that were preserved away for over 50 years. Some investors wish to collect coins for the sole purpose of collection, as well as, sale purposes. The coins collected and in mint condition have a high premium value, which can increase with time as long as the coins are well preserved.

What makes this story even more special is that the treasure discovered led to the survival of numerous bank institutions through the Great Depression period. The great depression occurred and led to the collapse of millions of banks. Not only were financial institutions favored to go through the great depression due to the coins preserved, but there was specialization with precious metals for instance gold, silver, and platinum.

The discovery of the treasure chest led to many partnerships among the Federal Reserve banks (1914). During this time, partnerships among such big banks meant that the great depression could not affect them as such compared to other banks. One aspect that made the reserve bank powerful is the coins collected throughout the period. The coins collected acted as a treasure hoard since they could be sold to other banks to acquire the required capital. Such a success story in The Bank of New York Hoard makes it a historical marvel.

Treasures Hunts and Inflation

The treasure chest discovered in The Bank of New York Hoard story enabled the expansion and reform of the banking systems in place during the period. The credit system during the time meant that banks could borrow from other banks to keep afloat. The banks were threatened by the increasing rate of inflation across the country.

Banks that also dealt with precious metals were also affected especially if the precious metals lacked premium value. Possible solutions included the treasure chest discovered in The Banks Like The New York Hoard. Experts like David Hume discovered the importance of preserved treasure in overcoming tough economic situations.

Yes, it is about time that you look at that treasure map once more just in case you might find it hidden away.

This however represented a metaphor whereby you should have a second plan in place to deal with difficult situations. Due to the high value of the coins gathered and collected during The Bank of New York Hoard, they were bought by the U.S. Treasury. The purpose of buying the coins was to ensure that the collected pieces were reserved well. More importantly, it served the purpose of ensuring that all banks were unified under a common theme.

For a long time since the coin was invented, there was a division among the financial institutions. The banks that lacked enough coins: gold or silver were not given the same priority as other institutions that had the funds. On this note, the discovery of the treasure map and treasure chest led to the Royal bank receiving preferential treatment from distinguished leaders in the treasury. As noted earlier, the bank was later purchased by the US treasury symbolizing the power of gold and silver coins. Additionally, coins that were in pristine condition increased in value during the sell-out. Such aspects show the significance of a treasure chest.

How Important Are Treasure Chests?

It is vital to have gold and silver preservatives since this guarantees future investments. Yes, in layman's terms, it is vital to save for your future. Without the treasures discovered in The Bank of New York Hoard, Institutions would not have achieved the financial success and status to form partnerships with the US Treasury. The preserved precious metals served the purpose of providing insurance during the great depression. We can all agree that not many businesses survive during such a period.

It is, thus, safe to say that the investment in precious metals safeguards the interests of all relevant investors and collectors. More importantly, precious metals can be bargaining cards for the relevant stakeholders to gain a competitive edge financially through investments. Through such aspects, coins and precious metals preservations ensure the success of relevant investors and collectors, as well as, financial institutions.

Have you considered whether Gold is important to the economy as much as it is important for financial institutions? If so, then you can agree that relevant stakeholders must ensure they undertake the relevant research to determine if it is more valuable than money. One gold bar is worth around $1500, thus preserving such precious metals for future use ensures that in case of another economic meltdown, there are measures in place to help with such problems.

Investing in the future is recommended since it not only preserves the future generations but also financial institutions. Why not decide to be economically ready in case there are money problems in the future both as an individual or an institution through investing in gold, silver, and other treasure chests?