Gold Price Surges as Coronavirus Spreads

The 2019 coronavirus, also known as Covid-19, was first reported in Wuhan city in Hubei province, China. This virus belongs to the same group of viruses as SARS and MERS. The reported symptoms of the infection include fever, coughing, and breath shortness. The novel coronavirus is rapidly spreading from China to other parts of the world, threatening to become a global pandemic.

After a string of new outbreaks outside China and some heart-stopping plunges in global stock markets, we must now start looking at the ultimate economic impact of the virus and how we can respond to it.

Experts are warning that Covid-19 presents one of the biggest dangers to the global economy since the financial crisis. This fragility is being escalated by other factors such as ongoing US-China trade wars, Brexit, and other geopolitical issues that have the potential to affect the financial world and global economic systems profoundly.

One of the areas where Coronavirus is already wreaking havoc is within the global supply chain. Decades of globalization have created supply chains that are so interconnected, making it harder for governments to manage the dramatic ripple effects of a shock event like Coronavirus.

According to the Federal Reserve's Beige Book report released earlier this month, the outbreak was starting to have an impact on the U.S. economy. The report also warns that with Coronavirus's effect on the supply chain, the manufacturing sector is likely to start feeling the heat in the coming days.

Coronavirus Impact on Supply Chain

China is the world's 2nd largest economy after the U.S. and perhaps the most integral and indispensable player in the global supply chain. Yet, since the outbreak, some of the largest manufacturing zones in the country have been on lockdown. While others are operating at below capacity as the country grapples with cases of new infections. This has affected global manufacturing and supply operations tremendously.

Companies outside China are reeling with the cascading effects of the lockdown with many reporting delays in their shipments. U.S companies that rely on China for production, or as an end market, will all be affected until the coronavirus outbreak is brought under control. As a result, many of these businesses are expected to post lost revenue in the first quarter.

So far, however, the economic impact of the virus appears limited to the stock market with declines in several S&P 500. The virus has already had far-reaching effects on industries, including manufacturing, retail, travel, technology, automotive, health, and energy. Some of the companies that have reported snarled up supply chains have also seen a decline in their stocks. These companies include:

- Car plants that remain closed in china. Major global car manufacturers such as Volkswagen, Toyota, General Motors, Daimler, Renault, Hyundai, and Honda are yet to resume their operations in China. As a result, S&P Global Ratings estimates that carmakers will have to slash their production in China by up to 15%.

- Luxury goods makers who rely largely on the Chinese markets have also been affected as a result of the coronavirus spread.

- Qualcomm, the world's largest smartphone chips manufacturer, has also hinted uncertainties around the smartphone industry.

- Major firms such as Nike, Apple, and Walt Disney, which rely heavily on China for business and supplies, are also some of the hardest hit.

These cases of disrupted supply chains are continuing to create uncertainties and anxiety that is affecting the financial markets considerably. With increased coronavirus impact on supply chain across the globe, investors should now be aware that their shares could become vulnerable to declines in the coming months.

We Should Expect More Slowdown Locally

The spread of the Covid-19 virus in China and across its borders is already getting financial markets rattled. But besides the financial markets that have reacted relatively sharply to the virus outbreak, cases of Coronavirus within the U.S. and other territories are also likely to lead to a more pronounced slowdown as people shy away from restaurants, theaters, and other places with mass gatherings.

The travel and tourism industry is already feeling the heat after several travel bans and travel advisories to/from countries such as China, South Korea, Iran, Japan, and Italy, which have already reported significant Covid-19 infection cases. It is therefore not surprising to see that oil prices have already declined sharply, reflecting concerns that the virus outbreak and its containment measures might lead to lower oil demand. Other investment assets might also not be aloof to these effects in the long run.

The question then that every investor must grapple with is: how the virus will spread in the coming days; how soon we can expect a vaccine/cure; and the general effect that this outbreak will have on investments.

Though, a few things are already quite clear now; one thing most willa gree on is that the economic growth for most companies, especially those relying on Chinese manufacturing and consumer market, will experience slowed growth in the first quarter of this year. This is because the virus outbreak coincides with the Chinese New Year, which is usually a definite period for retail sales.

What happens beyond the 1st quarter will solely depend on the severity of the Covid-19 outbreak, and stimulus strategies by central banks to revamp an already damped economy. But placing these factors together, the picture does not look particularly rosy.

What the Markets Are Telling Us

With more new infection cases across Europe, the Middle East, and the United States, major global financial markets are beginning to react strongly. The economic costs of the virus are already mounting by the day. Reports indicate that roughly $2 trillion has already been wiped from the stock market in a matter of days. Here are some highlights that show how the markets are responding in light with the virus outbreak:

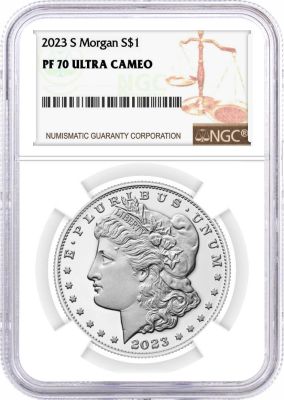

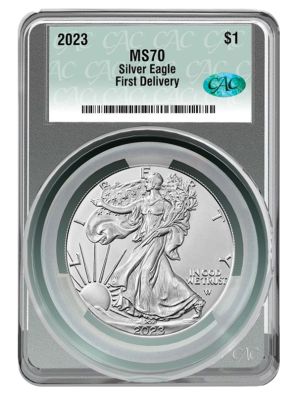

- Gold surges as Coronavirus spreads with the precious metal hitting a seven-year high at the end of February

- Spot gold inched higher by 0.2% to $1,639.44 per ounce.

- Gold futures have also seen an explosion in prices.

- The interest rate cut by the U.S. Federal Reserve is going to support non-yielding bullion.

- The S&P 500 and Nasdaq have dropped by 3.2% and 3.8%, respectively.

- Earlier this month, The U.S. Treasury bonds hit an all-time low of 1.9%.

- The Dow Jones is also down by about 1,000 points, the third-lowest in its history.

- Due to the coronavirus impact on supply chain, shipping companies are reporting a sharp drop in container volumes.

- Hyundai has shut down operations in South Korea due to the lack of parts from China.

- By the end of the first week of March, Silver inched up 0.2% to $17.21 per ounce, indicating that the virus risks continued to support safe-haven interest.

Other effects that are becoming more evident by day include fewer foreign tourists, declining travel, supply bottlenecks for tech companies and automobile makers due to coronavirus impact on supply chain. Goldman Sachs is predicting that the U.S. growth will shave eight-tenths of a percentage point due to the virus outbreak.

What's next, then? Well, since we don't know how much the disease will cost and how far it will impact global economies, investors must take safety-first measures to contend with the baleful effects of the virus. You need to make sure you have a diversified portfolio. You also need to understand how each of your asset classes will respond in times of turbulence. This way, whether the virus fizzles out or blows out, you'll have your investment portfolio well protected.

The Implication For Precious Metals In Light Of The Coronavirus

An increase in Covid-19 cases in the coming days might lead to severe ramifications on global industries, markets, and supply chains. The economy slowdown due to the virus might eventually ripple through most areas of the economy.

Savvy investors must look for other defensive asset classes to invest in to protect their portfolios against these global worries. One such safe-haven investment is in precious metals such as gold, whose demand has increased with the rapid spread of Covid-19 outside China.

With gold surging as the Coronavirus spreads, people who are looking to hedge against the downturn in the global economy are finding it more appealing as a form of investment insurance. Gold is always an excellent investment option in times of financial uncertainties. It, therefore, makes sense that the safe-haven asset is responding to a worsening market mood amid the virus crisis.

Why Gold Makes a Good Investment to Abate Coronavirus Driven Fears

Gold is considered a safe investment that can hold your wealth for a long time without yielding to market pressures such as inflation and geopolitical uncertainties. It is, therefore, not surprising to see the gold surges as coronavirus spreads. Turning to gold in such a time when there is fear in the market will help you hedge against a falling stock market.

When investing in gold, it is essential to realize that it performs best as a diversification to act as a haven in case of a possible economic meltdown and hedge your investment against a potential stock market crash. By pairing gold with other assets such as stock, it will offset any underperformances in your portfolio.

Investing in gold, even in the light of Coronavirus, provides you with massive benefits, including:

- Gold has unparalleled liquidity: You can easily convert your gold to cash when the markets stabilize.

- It can be a hedge against inflation: Gold will always appreciate when the value of the dollar goes down. Having an investment in gold bullions ensures that your wealth is protected even when the value of fiat currency is doing poorly.

- Gold holds its value: If you're looking for a long term investment, gold and other precious metals should be part of your investment portfolio. The underlying value of gold doesn't depreciate even with time.

- Gold is an excellent diversification tool: Adding gold to your investment portfolio lowers the overall risk of your investment. When other assets classes are going south, you are likely to yield more with a gold investment.

- Gold is used as a raw material: Besides holding value, gold also tends to have multiple uses in the production of various products such as electronics and jewelry. This ensures that there is always a reliable demand for gold.

- Gold is a universally desired investment: In today's geopolitics, gold stands as a universal commodity that can be traded anywhere in the world without losing its value.

Why Buy The Yellow Metal?

The Covid-19 outbreak continues to weigh down on the global economy. An increase in the number of confirmed cases in China, South Korea, Japan, and Italy, has sent global stock markets tumbling due to fear and uncertainties. Yet, with quarantines in place and manufacturing shutdowns in China, these fears are well-founded.

By the end of February, S&P 500 and Nasdaq had lost close to 3.35% and 3.71%, respectively, while Dow Jones Industrial fell by 1,032 points. This was the third time in history that the index had lost over 1000 points.

This situation has played out in favor of gold. Despite the slumped economy, the yellow metal has become a go-to investment tool for many investors right now. The increased focus by the Fed to introduce stimulus measures is also pushing more investors to buy into the bullion.

With an investment in Gold bullions, investors can use the precious metal as a safe-haven and a hedge against the roaming fears of a pandemic, coupled with uncertainties in the US-China trade front, the Brexit mayhem, a weakened manufacturing sector, and a disrupted supply chain.

Are you looking to diversifying your portfolio with an investment in gold and other precious metals? Talk to an expert today and learn more about the market, and you can use gold and other precious metals to store and hedge your wealth.

If you’re interested in buying gold, you can explore the collection at IPM here. Feel free to learn more about rare coins and precious metals by checking out our other unique blog posts, including Is Gold a Good Investment, The Most Valuable Coins In Circulation, & Is it Safe to Buy Gold & Silver Online.