How To Hedge Against Inflation

How You Can Hedge Against Inflation

With the U.S. economy still bloated from the injection of trillions of paper dollars in response to last decade's recession, inflation remains a serious threat to savings accounts. But there are ways to balance your portfolio that can minimize, prevent or even reverse losses. Being proactive can mean the difference between riding the wave of inflation and losing everything. Diversification is a key step in protecting your hard-earned savings. Make sure your assets include precious metals, which have consistently performed as hedges against inflation and the devaluation of the American dollar.

Gold as a Hedge Against Inflation

Gold, long considered the king of precious metals, has been used as currency for more than 3,000 years and, since its discovery, has maintained its inherent value. The idea of gold most often conjures images of jewelry. But the yellow metal is also a critical component in many electronics. It is in high demand not just for its physical beauty, but also its ability to withstand high temperatures, resist corrosion, conduct electricity and retain chemical stability. But beyond its inherent value, gold can also protect your other assets. The precious metals is tangible and unlike commodities, which lose value through use, gold appreciates in value as the U.S. dollar falls.

Make Sure to Invest in Silver

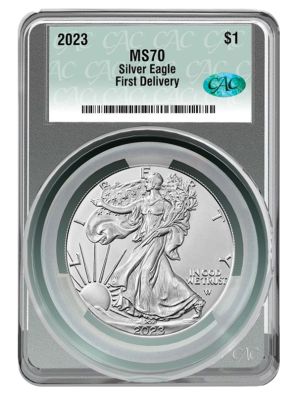

Silver has historically been the most affordable precious metal. Discovered after gold and copper in 4,000 BC, it has since been in demand for several reasons. Beyond its usefulness in jewelry making and as a medium of exchange, its industrial properties have made it the most used metal in the world, with no known substitutes. Silver is the most electrically and thermally conductive and reflective metal on earth. It is not only used in the electrical, electronic and automotive segments, it is also used in the manufacture of mobile devices. With an uptick in production of these devices, coupled with a rebounding economy, the value of silver has nowhere to go but up.

The Best Hedge Against Inflation Is...

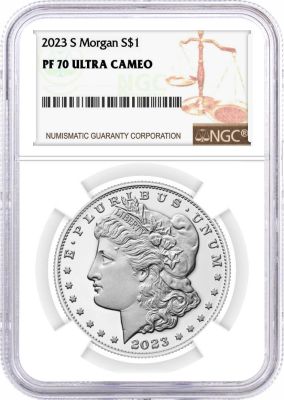

Diversifying your portfolio with precious metals like gold and silver is the best hedge against inflation. And because the prices of gold and silver are independent of each other, the inclusion of both in your portfolio allows the positive performance of one to balance the negative performance of the other. Gold and Silver American Eagles are an excellent way to bring these precious metals into your portfolio. The coins have historically provided a hedge against inflation. The weight and purity of American Eagle Bullion coins are backed by the U.S. government and as such can be traded nearly everywhere in the world. They offer one of the most liquid forms of investment available. Anyone looking to hedge against inflation is clearly looking in the precious metals sphere, namely because precious metals represent a physical, tangible item that one can own - thereby making it likely safe from any huge inflation drops within currency.

About the Author

Call now 800-781-2090

Tags