Should I Buy Platinum?

So far in 2014, we’ve seen many good reasons to start thinking about platinum as a real investment. Mining strikes, along with increased production, are starting to put pressure on the price. At $1514 per ounce, it is near the 52 week high of $1543.

Worldwide Usage

Platinum has historically been regarded as the most precious of all precious metals, and rightly so, as it is nearly 15 times more scarce than gold, and with no known stockpiles. And because one in every five consumer products either contains platinum or was produced using the precious metal, it remains in high demand. Currently, roughly 45% of platinum is used for vehicle emissions control devices, and another 30% for jewelry. The remaining 25% of platinum is used for a combination of investing, laboratory equipment, dentistry equipment, electrodes, spark plugs, electrodes, and turbine engines. Because of its scarcity, only a few hundred tons are produced each year, with nearly 80% of that production coming from South Africa.

History of Platinum

The metal was initially discovered in the early part of the 16th century by Conquistadors, and derives from the word ‘platina’, which literally means: little silver. However, it only became more recognized and known in around 1741, when British metallurgist Charles Wood discovered it in Jamaica, and sent it back home for further research. Only recently, however, has platinum become an investment option. Platinum's scarcity, coupled with the industrial demand for it combine to make it a solid asset with great potential. Platinum generally tracks the price of gold but, given its necessity to so many industries, it is predicted to surpass it gold’s value in the future. Additionally, the price of platinum is more volatile than gold, and is subject to higher drops and higher jumps.

Government Platinum

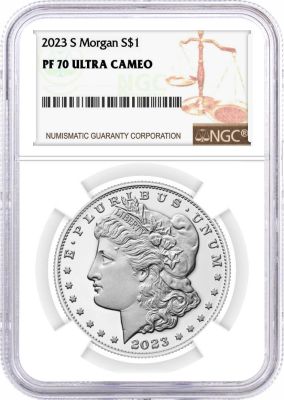

American Eagle Platinum Bullion Coins offer an excellent vehicle for including this precious metal in your portfolio. First authorized by U.S. Congress in 1996 and then minted in 1997, they are the only official investment-grade platinum coins from the United States Mint. Platinum Eagles are beautifully designed bearing a portrait of the Statue of Liberty on the obverse and a soaring bald eagle framed against a setting sun on the reverse. These Platinum Eagles are the only platinum bullion coins whose weight, content, and .995 purity are officially guaranteed by the U.S. Government. They are sold in one ounce only.

True Value of Platinum

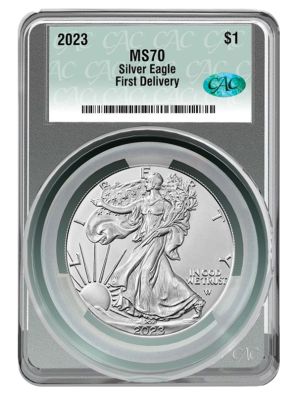

Their face value is mostly symbolic because platinum's market price has historically been higher. The metal is currently outperforming both gold and silver. Platinum Eagles are legal tender and can be sold for cash and coins at precious metal dealers the world over. Buying the platinum bullion is as simple as visiting your nearest coin or precious metals dealer or even a brokerage house or participating bank. They are available in four denominations and sell at a variety of prices, and they sell at the prevailing market price along with a small premium to cover their coinage and distribution costs.

Platinum has historically been a lucrative investment, and with a guarantee from the U.S. Government, Platinum Eagle coins certainly represent a great opportunity to get in on the platinum rush.

About the Author

Call now 800-781-2090

Tags