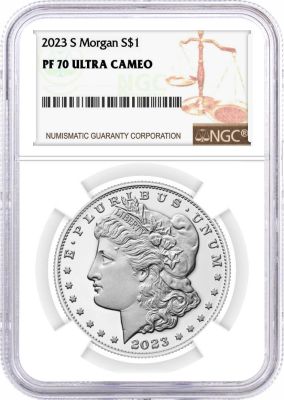

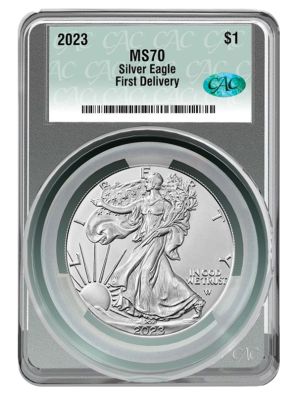

top gold and silver recommendations

proudly affiliated with these fine organizations

Diversify with Gold

LEARN HOW TO DIVERSIFY WITH PRECIOUS METALS

Get Started Today

Complete the form below or call

(800) 781-2090 to get started

experience you can trust

International Precious Metals was founded in 1995. We have grown to become one of the largest and most recognized nationwide dealers of U.S. Mint Eagle coins, and a leader in rare historic U.S. Gold and Silver.

We're proud to be one of only twenty companies to be recognized as a National Dealer in official United States Mint literature. While these listings do not imply endorsement for any dealer, one can readily infer that there are reasons why this roster is so small.