IRA Eligible

Please call about including these items in your IRA

IRA Eligible Coins for Your Portfolio

Coins aren’t just collected for fun. Many people invest in them as part of their retirement planning. In fact, the opportunity to include precious metals in your self-directed IRA gives you more control over your financial future.

Not all coins are able to be used in your portfolio, however. For that reason, you must ensure that you are purchasing IRA eligible coins and bars if you intend to use them as investments.

What are IRA approved coins?

They are coins made from precious metals that meet the Internal Revenue Code’s strict requirements. For example, the coins or bars must be produced by a refiner who is both approved and accredited. In addition, the metals must meet certain fineness requirements based on the type of precious metal. For gold, it must be .995 with one exception for a particular gold coin.

IRA Eligible Gold Coins

If you are interested in incorporating IRA approved gold coins, you’ll be happy to know that there are a lot of options, including:

- American Eagle Coins

- Austrian Philharmonic Bullion Coins

- American Buffalo Coins

- British Britannia Bullion Coins

- Australian Kangaroo Coins

- Canadian Maple Leaf Coins

- Pearl Harbor Coins

- And More!

As mentioned before, all gold IRA coins must be at least .995 fine, but there is one exception to the rule. The Gold American Eagle Bullion coins don’t meet the purity guidelines because they have a fineness of .9167. The IRS, however, still allows for them to be included in your self-directed IRA.

Another exception to be aware of: coins graded for their condition are considered collectibles by the IRA. Therefore, they are not allowed in IRAs even if they meet the other fineness requirements. If the condition of the coin is important to you, you can always wait until after you’ve liquidated your IRA to have them graded.

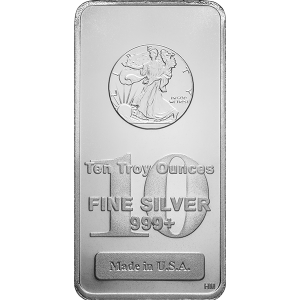

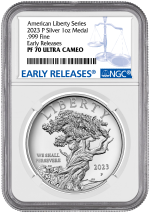

IRA Eligible Silver Coins

For the most part, determining whether or not you have IRA eligible silver coins is much like the above process. The biggest difference is that the silver must have a fineness of .999.

Similarly to any other precious metals, the coins must be purchased directly from a custodian. That means any coins that you currently have in your collection cannot be included in your IRA, even if they meet all of the necessary requirements.

If you would like to expand your IRA with silver coins, we recommend that you look for:

- American Eagles

- British Britannia Coins

- American the Beautiful Coins

- Canadian Maple Leaf Coins

- Australian Kookaburra Coins

- Mexican Libertad Coins

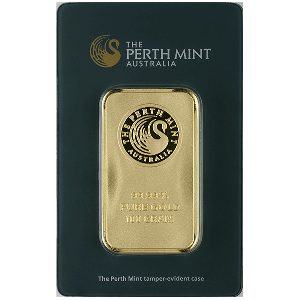

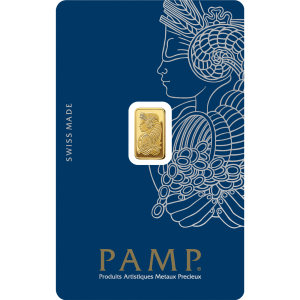

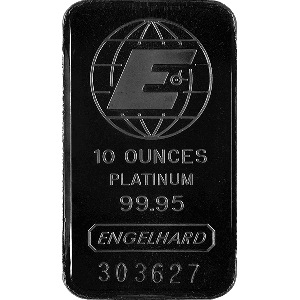

IRA Eligible Gold and Silver Bars

In addition, to IRA approved coins, you can also invest in precious metal bars. The IRS holds the gold and silver bars to the same fineness requirements as their coin counterparts.

Some of the more popular IRA eligible gold bars include:

- Royal Canadian Mint Gold Bars

- UBS Gold Bars

- Valcambi Gold CombiBars

- Sunshine Mind Gold Bars

- Credit Suisse Gold Bars

- Johnson Matthey Gold Bars

If you are looking to invest in some IRA approved silver bars, you should consider:

- Royal Canadian Mint Silver Bars

- Johnson Matthey Silver Bars

- Sunshine Mint Silver Bars

Where to Buy IRA Approved Coins

Are you interested in learning more about which coins and bars you can add to your IRA? If so, the knowledgeable professionals of International Precious Metals are here to serve you. You can contact us 24/7 with any questions regarding IRA approved coins. We also have a vast online inventory that makes it easy to shop for investment coins and bars, so feel free to take a look!