Rare Coins for Growth

Rare Coin Investments - 30 years of Growth!

You’ll find rare U.S. gold coins in the investment portfolios of some of today’s most successful and respected Americans. Why is this? Rare U.S. gold can offer greater return potential than practically any other investment vehicle, and give you the opportunity to hold genuine historical treasures that reflect the development of our nation in a powerfully symbolic way. It’s easy to get started in rare coin investing, even if you’re not familiar with the rare coin market.

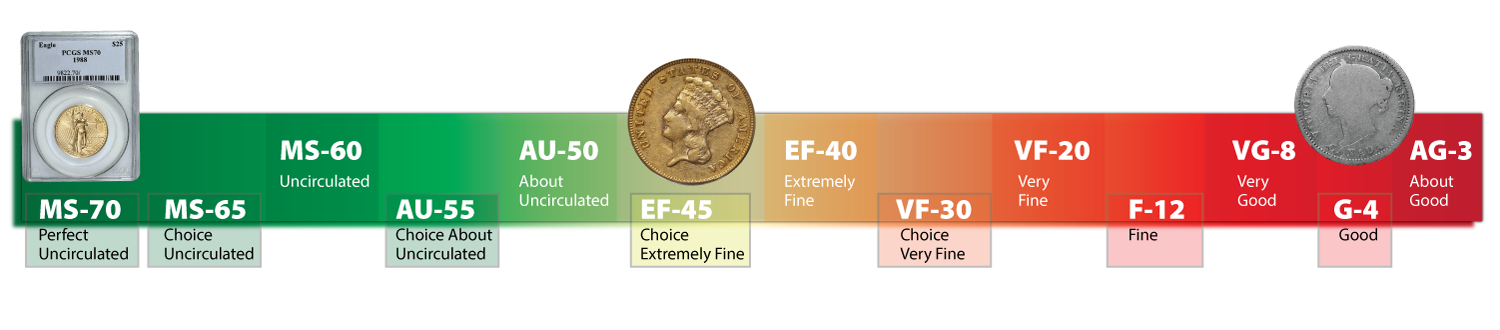

Standardized coin grading has taken much of the guesswork out of choosing and assessing the investment potential of any given rare coin. Grading is a way of determining the physical condition of a coin. Grades range from Poor (almost completely worn out) to Perfect Uncirculated (a coin with absolutely no wear and no flaws of any kind). Over 99.9% of all coins fall somewhere between these two extremes. The grade is “shorthand” for describing the condition of a coin. With experience and the aid of the appropriate books, many people can learn to grade with a moderate degree of accuracy.

The grade of a coin goes a long way in determining the coin’s value, and sometimes a seemingly insignificant and easily overlooked flaw can make thousands of dollars of difference. Coins that have been properly stored since the day they were minted are called “Uncirculated” or “mint state.” If a coin saw circulation for a short time but still looks nearly brand new, it is called (or graded) “About Uncirculated.” After that, the grades in descending order are Extremely Fine, Very Fine, Fine, Very Good, Good, About Good.

Uncirculated coins have different grades as well, depending on how carefully each coin was made, handled, and stored. Some uncirculated coins have heavy marks caused by contact with other coins during minting or storage. Other uncirculated coins are nearly free of such marks. The coin in the best state of preservation will almost always have the greatest value. The numismatic return potential of rare coins makes them an obvious investment choice, but the benefits don’t end on the balance sheet. The chance to own a truly irreplaceable national treasure is a privilege for anyone proud of America’s rich history and heritage. Viewing and holding these coins can bring the same sense of awe one feels when viewing important national treasures in a museum.

As the curator of your own collection, you can feel pride in the fact that you are helping preserve our nation’s heritage. As you hold your coins, you probably won’t be able to help yourself from wondering whose pockets they may have occupied in a previous century — Henry David Thoreau, Ulysses S. Grant, or maybe even a bandit like Jesse James or Billy the Kid!

In years past, collecting truly rare gold and silver coins was an investment opportunity reserved for true experts and the wealthy investor who could afford the unbiased judgement of a third-party numismatist. The advent of standardized grading has changed all of that, and today coins are traded sight-unseen based on the certified grade assigned by organizations like PCGS (the Professional Coin Grading Service) or NGC (the Numismatic Guaranty Corporation). This frees the investor from the need to understand fine grading nuances and the complex vocabulary of the professional numismatist. This revolution in the rare coin market has drawn many new investors who were previously unfamiliar with rare coins.

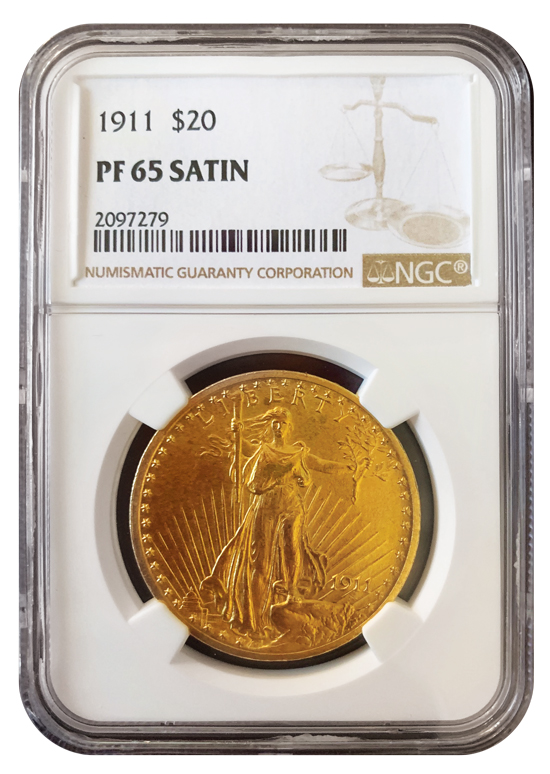

When coins are sent to PCGS or NGC, they are evaluated by a whole team of professional numismatists. So thorough is the assessment that assigned grades are readily accepted by even the most discerning dealers and collectors. Once graded, the coins are sealed in a special capsule, sometimes called a “slab,” that is imprinted with the grade, a unique identifying number, and a tamper evident hologram. The capsule serves both to preserve the coin’s grade by protecting it from environmental factors that could impact its condition, and to provide assurance that the coin has not been switched or otherwise tampered with.

Investors who are holding bullion gold, silver or platinum should seriously consider diversifying into rare coins. Whereas the primary role of precious metals bullion has been to serve as a portfolio balancer in recent years, rare and numismatic coins have been active high performance investment vehicles. Many investors who have enjoyed the security of holding bullion are now looking for an investment that can offer this enhanced return potential. These investors can add this depth to their portfolio even without making a new investment by trading a portion of their bullion holdings for rare coins.

IPM can help you build an investment strategy that will weather rough economic times. Investors who rely exclusively on stocks and bonds can find themselves vulnerable as market conditions change, but the portfolio that is fortified with bullion and rare coin holdings can flourish, come what may.

Get Your Free Guide!

International Precious Metals has been able to successfully hunt down some of the finest pieces in existence for our VIP Clients. While some investors and collectors don't necessarily have a preference with their acquisitions - they're simply happy to hold whatever metals products they can get their hands on - others are on a journey to secure the best of the best. These clients are focusing on the future and what they will be proud to pass down through their family in the years to come.

1911 $20 Saint-Gaudens Proof 65 ‘Satin’ by NGC

1921 ‘High Relief’ $1 Peace Dollar Proof-62 ‘Satin’