What are Treasure Assets & Trends?

What are Treasure Assets?

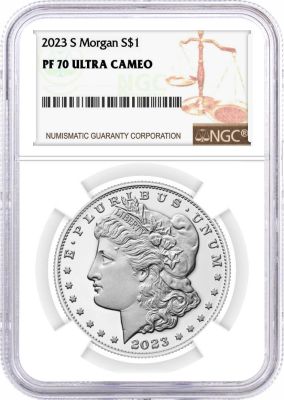

Treasure Assets, also known as “passion assets,” are tangible collectibles including classic cars, stamps, fine art and jewelry as well as coins. These are the assets collected for their beauty as well as their worth. They can be aesthetically pleasing, sentimental or rare, but they are all increasingly becoming serious investments. Recent wealth reports find that the global economy's biggest players are moving towards collectibles as an investment vehicle.

Treasure Trends

Treasure assets have given U.S. stocks a thrashing over the past decade. And in the short-term, coins have been outperforming all other treasure assets. Over the course of 2013, markets reported an increase in gains of +25 percent for coins, giving coins the fastest gains in the treasure assets class. The total increase in gains for coins over the past decade is +248 percent. With the erosion of equity through market volatility and record low bond yields, collectible assets - particularly coins – are drawing investors.

Coin Collectibles

At the close of 2013, official mints reported that the following are the top 5 gold coin sales:

- Gold Maple Leaf: 1,140,000 oz.

- Gold Eagle: 856,500 oz.

- South African Krugerrands: 750,000 oz.

- Gold Philharmonics: 544,000 oz.

- Gold Pandas: 460,082 oz.

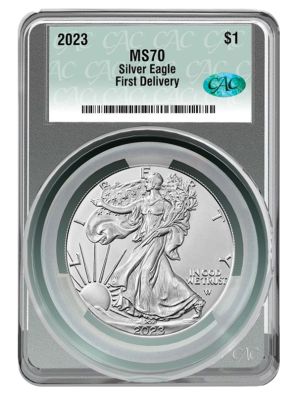

Silver coins were very popular in 2013 as well, with the data listed below:

- Silver Eagles: 42.6 million ounces.

- Silver Canadian Maples: 28.2 million oz.

- Philharmonics: 14.5 million oz.

- Silver Pandas: 8 million oz.

- Australian Kookaburra’s, Koala's and Lunar Silver Snake: 5.3 million oz. (Click here for the 1 oz Kookaburra, 10 oz Koala, and 1 oz Koala)

Future Treasure Trends

Coins provide a hedge against inflation and currency devaluation because their value is independent of the prevailing currency and the stocks markets. They also possess longevity, in part because they are easy to protect from degradation. They are also easy to handle, store and transport.

Coins serve a dual purpose unlike any other treasure asset class in that they can be used as currency and are accepted as such the world over. Coins are made of precious metals which are currently outperforming commodities and equity markets. They are readily available and collections can be started on a small budget. They are one of the few treasure assets that are easy to resell. Of all the assets listed as treasures, coins are the likeliest candidate to lead the pack in terms of growth in 2014 and beyond.

About the Author

Call now 800-781-2090

Tags