Precious Metals vs Stocks

Precious Metals vs Stocks: A Look Back

Owning precious metals, while providing protection against inflation, as well as stability and security, did not provide the investor with the short-term profit gain of a stock. Yet during times of economic crisis, owning physical precious metals has shown its advantages over traditional investments. Factors affecting precious metals are unique. Studies have shown that precious metals may have no correlation or even a negative relationship to the price of stocks, making them an excellent hedge against the fluctuations that have affected other asset classes.

The Modern Value of Precious Metals & Stocks

Three key factors over the past few decades have seen precious metals overwhelmingly outperform stocks.

- As the world's supply of physical commodities like gold and silver is diminishing, the value of precious metals has been increasing in response to cash infusions meant to help keep the economy going.

- Against the backdrop of a global debt crisis, investors are forgoing the short term profit of stocks in exchange for the long term security offered by precious metals. Recent economic upheaval has inspired a resurgence in the role of metals both at home and abroad.

- A market in which individual investors are being squeezed out by computerized trading has led to money market volatility. Investors no longer trust the safety of their investments and are turning to a more reliable and portable store of wealth.

The Future Value of Stocks

The bubble forming in the U.S. middle markets doesn't bode well for the future of stocks. Symptoms of a burst are reportedly more prevalent now than they were at the peak of the bubble in 2007. And as was seen during the financial crises beginning in 2008, asset classes can decline simultaneously, creating broad losses for private, government and institutional entities. Stocks are too risky in today's financial climate.

The Future Value of Precious Metals

Physical precious metal is private, secure and immutably valuable. Throughout history, it has retained its value through the collapse of governments and entire cultures. No paper asset can offer the same bottom line security and there is no reason to expect that should change in the future.

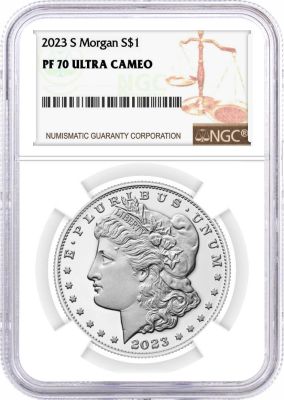

[caption id="attachment_186" align="aligncenter" width="378"] Gold American Eagle Coins[/caption]

Choosing which precious metals to invest in can be tricky. Please feel free to read our rare coin guide to learn the ropes for precious metal and coin investing. An additional option that is becoming more popular among precious metal and coin investors are US Mint coins, in particular, the gold American Eagle coin.

The prices of gold, silver and platinum are independent of each other. So a diversification of the precious metals in your portfolio allows the positive performance of some to balance the negative performance of others. These metals will continue to offer steady growth and security because their value is independent of the prevailing currency and the stocks markets. Studies have confirmed that portfolios containing precious metals have shown better absolute performance, and far less volatility than those that do not.

If you have any questions or interest in pursuing precious metals investing, definitely contact us here.

About the Author

Call now 800-781-2090

Tags