Collecting Coins to Pass Down to Your Heirs

Passing A Coin Collection Down to Your Heirs

When most folks think about legacies and passing money to heirs, they think about ways to pass their assets on to the next generation. Some folks focus on real estate while others think about stocks and bonds. Then some want to hedge their bets a little more securely in the form of precious metals like gold, platinum, or silver. And then some go one step further and invest in rare coins as a way to transfer wealth - and a little bit more.

History speaks for itself

Over time, coin collectors have realized good returns on their investments. Savvy collectors spend hours conducting research and even more time traveling to coin collecting events and rare coin shops. It's a passion that combines both an eye on good investment returns as well as a desire to experience history uniquely and interestingly.

Holding a piece of American history in your hand isn't the same as holding a stock certificate or a real estate deed. Giving that piece of American history to your children and grandchildren makes for special relationships, establishes and keeps traditions alive as well as demonstrates a smart way to invest.

Extra value

Seasoned investors as well as numismatic neophytes all want the best value for their investment dollar. Precious metals have continued to increase in value over time, so it doesn't require an advanced degree in finance to understand how to buy and sell gold or silver for a profit. Holding onto the asset makes sense as time only increases the value, but there's one thing about precious metals in the form of rare coins that increases their value.

While rare coins go up and down in value, in most cases, they are only getting rarer and rarer. That makes their value increase beyond the tare weight of the precious metal they contain. That's an added extra that smart investors like to include in their portfolios. Unlike stocks and bonds; if there is a market crash, rare coins will be a solid backstop in case of disaster.

Learning and earning at the same time

Becoming educated about rare coins is much easier in the world of the internet than it ever was before. Coin collecting students and gurus alike discover valuable information, communicate with experts, and keep an eye on coin values with greater ease than ever before. Newcomers have access to coin collecting and appraising veterans who can help them decide on which investments make the most sense for them and their goals. Becoming a numismatist isn't a requirement for becoming a rare coin collector or investor.

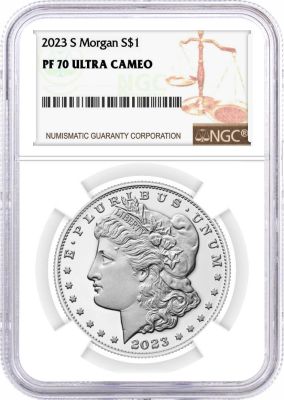

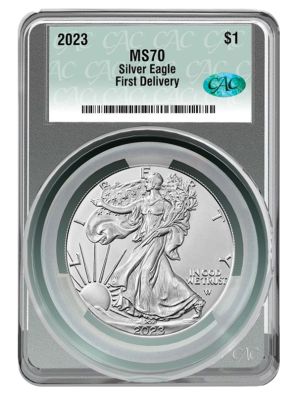

The condition means everything to coin collectors and investors

Whenever a rare coin collector considers a purchase, they first go to the appraisal of the target purchase. Some companies appraise and grade rare coins based on the coin's condition, its provenance (history), and other considerations before issuing a certified coin collection appraisal.

The valuation of the coin is a matter for other experts to determine, based on rarity and collectors market fluctuations. Remember, a silver dollar once owned by a deceased passenger on the Titanic is going to have greater value and provenance than the same issue of a silver dollar that has circulated under normal conditions.

Gold or Silver?

The decision as to which metal is of greater value is as much a factor of tare weight market price as it is to rarity. A silver dollar can be worth more than a $20 gold piece when it comes to rare coins, so the decision as to which type of metal is secondary to the piece's overall value.

Gold coin collection and silver coin collection are a matter of taste and preference for the collector. An investigation into individual rare coins produces a variety of valuation results that can move up or down depending upon the market and recent discoveries.

Paper or personality?

The one aspect of rare coin investment, as opposed to traditional investment channels, is that rare coins have a dual benefit. Stocks, bonds, CDs, and real estate deeds are two-dimensional representations of assets. Rare coins are three-dimensional wonders that have personality and character.

Holding a piece of paper doesn't compare to a solid, artistic, glistening artifact that captures the eye and the imagination. Stories told of distant lands or historic events combine with the excitement of holding precious metal. It's just a whole different feeling that brings about an emotional response like no other.

Safe and secure

Owning rare coins allows the collector to show off their possession. Special coin cases for collectors keep the coins in sealed plastic to resist corrosive deterioration. Some collectors hold their coins in climate-controlled environments to keep the precious items in peak condition.

Coin collection storage is also a matter of security from theft or damage. While bank deposit boxes are a good hedge against theft, most rare coin collectors like to admire and display their holdings at home or their offices. In those cases, security measures should be taken to avoid losses.

Start at the beginning

Switching a financial portfolio from stocks or ETFs to rare coins takes a little time and should be done with attention to the costs of cashing out stocks and the costs of buying rare coins. There can be commissions paid to dealers or brokers, just like stocks and bonds, so it's important to know what you're doing.

One excellent starting point is examining a coin collector's price guide. This coin collectors guide will give you ideas about coin valuations, trends, market changes, auctions, and other important places to gather data before making decisions. Coin dealers and experts are available at trade shows, coin shops, and on the internet. Finding a coin collecting mentor can help in many ways and make the experience more interesting and exciting.

Different strokes for different folks

Some folks want to convey as much asset value as possible to their heirs but they want to do it in a way that makes the experience unique and meaningful. Holding onto rare coins in an old coin collection inherited from a loved one provides financial strength and security. Moreover, it demonstrates a level of sophistication and understanding of precious metals that's hard to match.

The love and appreciation passed along with a beloved collection of valuable and important pieces of history cannot be diminished by time - only amplified. Solid, beautiful, and more substantial than paper, rare coin collecting offers a truly individualized way of conveying personality, value, and love to your heirs and benefactors.