How Do I Invest In Gold?

Where to Buy Gold?

When purchasing gold, the two major markets for the physical product are local shops and online retailers. While local shops have been the traditional routes for much of gold buying history, that is not the case anymore. With the advent of the Internet and online shops, gold can be purchased safely online. Also, purchasing online can now save you money, and of course offers more convenience, thereby rendering many local shops obsolete. Also, the fact that there are now a plethora of online shops selling gold means huge competition. This forces online stores to keep their prices competitive, and improves one’s chances of buying gold at prices close to the spot. Online precious metal retailers like International Precious Metals can offer an excellent range of choices and competitive prices.

How to buy gold?

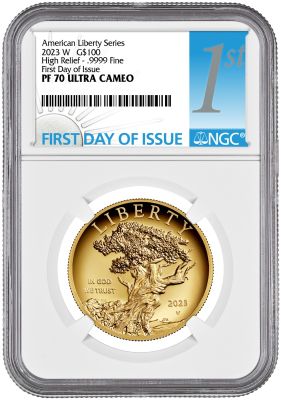

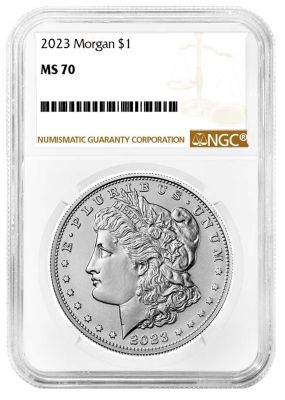

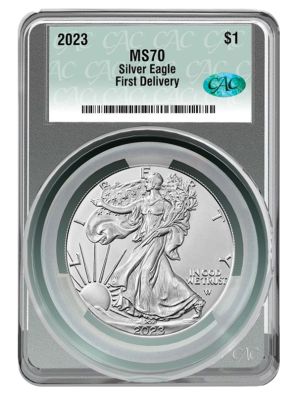

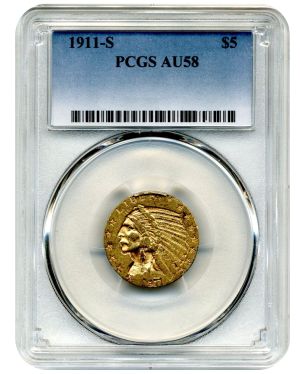

When buying gold, the easiest way is to buy bullion, which is gold in its purely physical form. The one ounce American Eagle Gold Bullion Coins offer an affordable way to buy gold for those with more limited means. It is important to note that Gold Eagles are backed weight and purity by the U.S. government, thus they are considered legal tender and can be sold for cash and coins at precious metal dealers the world over. St. Gauden's and the American Buffalo are other popular gold coin options for affordable prices. Another way to buy gold is through paper gold investments like gold exchange-traded funds or ETFs. These are mutual funds whose portfolio is fixed in advance and does not change. ETF’s trade like stocks, and only two are traded in the United States. Both of these ETF’s use gold bullion as their only asset.

Should I Buy Gold?

Two of the biggest allures of gold for investors are gold's performance as a hedge against inflation and its ability to maintain its inherent value throughout history. Gold is a portable, tangible asset that can't be tainted by fraud or scandal. Because you can actually hold it in your hand, the physical element of gold (bars and coins) allows for a safer for of currency which people can keep with them in their homes. These safe attributes make it a natural choice for investors. That is why it is important to have a trusted coin and bullion dealer when buying something expensive such as gold. International Precious Metals has over 20 years of numismatic and coin dealing experience, and is also mentioned by the United States Mint as a recognized coin dealer. Buying gold needs to be a secure and safe investment. Don’t hesitate to reach out to us with any questions – we are available 24 hours a day, 7 days a week to answer any of your questions and offer advice. Good luck investing!

About the Author

Call now 800-781-2090

Tags