Guide to Buying Gold

In times of economic uncertainties, people turn to gold. Why? It has remained a stable asset for centuries, and it has earned its place among the top investments in the world.

While many of its characteristics and benefits have made it popular, it also can be intimidating to the average investor. Much like the first time you dip your toe into the stock market, it’s easy to feel overwhelmed by the language and process of investing in gold.

However, you don’t have to let that stop you from making a solid investment in your future.

Whether you’re completely new to the world of precious metal investments or you simply want to learn more, we recommend that you keep reading this guide. We’ll tell you everything you need to know about:

- Reasons to Invest in Gold

- Different Types of Gold Investments

- Why You Should Only Invest in Physical Gold

- How Gold is Priced

- Where to Buy Gold

Why You Need to Invest in Gold

As we mentioned, gold has earned a reputation as a stable asset even when countries and people are facing economic struggles. That’s not the only reason that investors choose to add this precious metal to their portfolio, however. If you’ve been considering a gold investment, you’ll be happy to know that it can:

- Diversify Your Portfolio: Putting all your money in one place is never a good thing. Even if you invest in multiple stocks, you could be in serious trouble if the whole market crashes. Since gold only has a limited correlation to the stock market, it is often wise to add it to your mix of investments.

- To Hedge Against Inflation: If you are worried about inflation, gold is one of the best ways you can hedge against it. While inflation decreases the value of money, it raises the prices of goods, including gold, which means that gold has a negative relationship to the dollar. As a result, your money is better protected in the asset.

- Gold is a Limited Resource: We are getting closer and closer to peak gold production, but there is only a limited supply of gold. That means that as we get closer to mining it all, we also get closer to higher gold prices.

- Protect Yourself from Bank Issues: The US banking system is more stable than it has ever been, but it is far from perfect. There is always the risk of a crisis sending the banking system into a downward spiral. However, physical gold can protect you from the fallout.

Gold Investment Options

After you decide that you want to invest in precious metals, you have to determine how you’ll do it. When it comes to gold, you have several different options from which you can choose. Some might be better suited for your investment strategy and budget.

However, diversity within your gold investment is just as important as it is in your overall portfolio. We recommend that you invest in a mix of gold formats. The following are just a few of the different options you have when purchasing the precious metal:

- Gold Jewelry

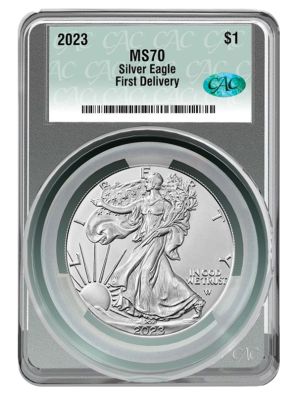

- Gold Coins

- Gold Bullion

- Gold Bars

- Gold Exchange Traded Funds (ETFs)

Physical Gold vs. ETFs

While ETFs are a great way to add some variety to your precious metal investments, you shouldn’t rely on them alone. There are plenty of reasons why people choose to invest in physical gold over non-physical options.

It’s important to know that gold is a stable asset only when you own it in its physical form. You can’t purchase an ETF and expect the same protection that you would get from physical gold.

That is the biggest reason that people continue to invest in gold coins, bullion, and bars. Having the physical gold in your hand gives you more control over your investment. It also is your insurance against any financial crisis that could occur.

How Gold Prices Work

You might have heard the words “gold spot price” as you started your research. What does that refer to? It is the price that gold is being purchased and sold for at that exact moment. Much like the stock market, these prices can go up or down depending on different factors, and you can view a chart of the changes.

Since the spot prices are typically dictated by futures, you shouldn’t expect to see products online going for the exact spot price you just saw. It’s much more complicated than that. You can expect most dealers to sell physical gold at prices slightly above the spot price.

Where You Can Buy Physical Gold

When you finally decide to invest in physical gold, you’ll find that there are several places where it can be purchased. There are local dealers, collectors, and even pawn shops that sell gold in its various forms. If you are more interested in coins, you might want to check out some collector’s events.

You will also find a plethora of online dealers selling physical gold in the form of coins, bullion, and bars. Obviously, you will want to work with reputable companies. You can vet different online dealers by researching their affiliations with precious metal industry associations. We also recommend that you look for dealers who have a relationship with the US Mint.

Contact Us for More Information on How to Invest in Gold

If you want to learn more about how you can add gold to your investment portfolio, we recommend that you contact us today. International Precious Metals is here to help you with all of your gold and precious metal investing needs. Our knowledgeable staff can answer any questions, and we can guide you through the entire process from start to finish.

To get started, we recommend that you contact one of our friendly service representatives. You can reach us by calling our 24/7 phone line or submitting our online contact form. We also have a convenient online chat function that will help you get answers to your questions quickly.

If you’re interested in reading more about precious metals, check out some of our other great posts including, ‘Gold vs. Bitcoin’, ‘How Precious Metals Protect Against Inflation and ‘Why Buying Precious Metals Will Keep You Safe From A Stock Market Crash’.