Gold vs. Bitcoin: Which Should You Invest In?

Lately, it seems that more and more people are talking about Bitcoin and other cryptocurrencies. As the popularity of digital currencies rises, you might find yourself wondering what that means for traditional investments.

Will crypto take over the stock market? What about precious metals? In a world where we are more connected to the internet than ever, is it even worth investing in gold anymore?

Whether you have been a precious metal investor for decades or are just dipping your toe into investments for the first time, we’re sure that you have a lot of questions about the future of gold vs. bitcoin.

Before you go selling all of your gold to buy crypto, there are a few things you should know. In this article, we’re going to provide you with more insight into whether or not you should invest in crypto vs. gold.

We’ll start by covering the basics, such as the difference between gold and Bitcoin. We’ll also be sure to go over such issues as:

- The Value of Crypto vs. Gold

- The Impact of a Recession

- The Possibility of Bitcoin Replacing Gold

- Will Gold Go up in 2022?

- Gold Price vs. Bitcoin

- BTC vs. Gold: The Better Investment Option

- How to Buy Gold with Crypto

Bitcoin v Gold

Bitcoin

The world was first introduced to the concept of bitcoin in 2008 after a person or group published a white paper under a pseudonym. The article discussed the idea of creating a peer-to-peer digital cash system that was solely based on an innovative ledge technology known as the blockchain.

At the start of 2009, the Bitcoin network emerged mining the genesis block, which would mark the first group of transactions to start the blockchain. From there, Bitcoin became a decentralized cryptocurrency that would allow transactions to bypass the most significant financial institutions in the world.

When Bitcoin entered the market, it was barely worth more than $0. By the time it began trading in July 2010, it was only worth US$0.0008. At this point, it had only garnered the attention of a few niche enthusiasts. Those digital gold rush pioneers were surprised to find that in one month’s time, the price had already grown to US$0.08

Soon after, people started to build large-scale farms and pools to mine Bitcoin, and cryptocurrency exchange finally appeared. However, it would take a decade for the skeptics to see the actual value of digital gold. Many wondered what will happen to cryptocurrency in a recession?

While the world’s strongest economies were reeling with the effects of the Covid-19 pandemic, Bitcoin held its value, and investors clamored to get on board the rocket ship before it would take off and reach US$61,000 in April 2021.

Gold

When comparing gold vs. crypto, gold is something people are much more familiar and comfortable with. It’s been a form of currency since it was first struck into coins around 550 BC.

Given its long history, we know that gold holds its value more steadily than other investments when the market makes corrections. In fact, it typically rises as investors trade in stocks for gold in anticipation of a recession. For this reason, it is a useful hedge that many people invest in to diversify their portfolios.

It’s also the reason that many investors chose to put their money in gold vs. Bitcoin when the Covid-19 pandemic hit. Though prices were sitting comfortably at US$1,300 at the end of 2019, they reached almost US$2,100 by mid-2020.

Through 2021, the price slowly dropped as economies began to recover, but the prices remain much higher than pre-pandemic levels. Currently, the value of gold is sitting just under US$2,000.

Aside from the fact that gold has been around centuries longer than Bitcoin, there are many other differences between crypto vs. gold. From the way governments choose to regulate them to their volatility, we’ll further detail how Bitcoin and gold differ.

The Volatility of Bitcoin vs. Gold

Volatility is defined as the liability to change quickly and unpredictably. It most often indicates a change for the worse, so when we look at the volatility of Bitcoin vs. gold or Bitcoin vs. silver, we are looking at how likely it is to lose your money

While Bitcoin has undoubtedly proven that it can make you a lot of money, it has also shown great volatility. Historically speaking, cryptocurrency has largely been affected by media reports, investors’ feelings, hype, and regulations. In fact, news relating to digital currency can either panic investors and cause the price to spiral downwards, or it can spur quick purchases and send the price soaring.

Perhaps it’s solely because of its history or for another reason, but volatility has remained lower in gold vs. crypto. Many investors view it as a safer asset because it is much less affected by outside influences. While that means you are less likely to lose a significant amount of money. It also means you shouldn’t expect to become a billionaire off of your modest investment either.

BTC vs. Gold Liquidity

If you want an investment that you can quickly turn into cash without impacting its market price, you need to pay attention to liquidity. Cash is the most liquid asset on that forefront, so you want to which has higher liquidity in BTC vs. gold.

In general, cryptocurrencies like Bitcoin are very liquid assets, but that might not always be the case. It largely depends on the market and how much you have. For example, many cryptocurrency exchanges have a cap on liquidation. If your cryptocurrency price is higher than that daily limit, you will have to sell the assets in smaller increments every day. However, those with fewer Bitcoins can typically turn their cryptocurrency into cash right away.

The liquidity of gold also depends greatly on the market and type of asset. If you have a gold bar in your home, it might take a bit longer to find someone willing to buy it from you the very same day. However, you can turn your gold into cash much faster when going through an online dealer.

Regulations for Crypto vs. Gold

When you consider, “should I invest in gold or Bitcoin?”, you’ll also want to think about how any regulations impact your trading. Current regulations can affect your ability to buy, but future laws could also impact the price of gold vs. Bitcoin.

Currently, gold has a well-established and highly-regulated system. It controls trading, weighing, and tracking to inhibit stealing or fakes. For example, many countries won’t allow you to cross borders with gold, and in many cases, you can only buy it from registered dealers or brokers.

You can expect fewer regulations with BTC vs. gold. There is currently no infrastructure that exists to regulate trading and tracking. Instead, its anonymity makes it more challenging to regulate. Fortunately, its encrypted and decentralized system makes it difficult to steal or fake Bitcoin.

Different Uses for Crypto and Gold

The value and longevity of an investment depend on how it can be used. If it has many uses, the demand will increase, and so will value. Fewer uses mean that there could be less demand in the future. In this case, utility is a big difference between gold and Bitcoin.

Gold has a lot of utility, which helps it maintain its value even when other assets fall. It can be used in the following applications:

- Currency

- Luxury Items

- Electronics

- Dentistry

- And More!

Bitcoin has limited utility because it is only a digital currency and investment. There is potential for it to be used in more applications in the future, but they don’t exist yet. If it becomes a form of lending, borrowing, and other financial transactions, we might see that change.

Similarities Between Gold and Crypto

While a Bitcoin vs. gold chart would show a big difference between gold and Bitcoin, the two investments still have many things in common, including:

- Scarcity

- Limited Bank Policies

- Alternatives to Other Investment

Scarcity

There’s a reason that Bitcoin is often called “digital gold.” It also has a limited supply and must be mined to be obtained. It can’t just appear out of thin air. In fact, the supply is capped at 21 million coins, which makes it rare compared to other cryptocurrencies, much like gold is rare compared to other precious metals.

Unaffected by Bank Policies

One of the many benefits of owning gold or Bitcoin is that they aren’t affected by any monetary policies that may be put in place by central banks or governments. Instead, they are essentially only affected by their supply and demand.

Alternatives

Just as gold has long been used as an alternative investment, Bitcoin has become another option for investors to diversify their portfolios. Given the right strategy, both have been viewed as a worthwhile investment for most people.

Gold vs. Crypto: Which is Worth More?

Any Bitcoin vs. gold chart will show you that Bitcoin has far surpassed the price of gold. While an ounce of gold will cost around US$2000, a single bitcoin will cost around US$40,000.

If you are making your investment decision solely based on the gold price vs. Bitcoin, you might be alarmed to see the difference. You might even think you can’t afford to invest in Bitcoin, but since you are able to purchase fractions of a Bitcoin, you can find an amount that fits your budget.

What Will Happen to Cryptocurrency in a Recession?

Cryptocurrency was created amid the last Great Recession. It was meant to be a decentralized digital currency that wouldn’t be affected by third-party intervention.

While it certainly has qualities that would indicate an ability to survive a recession, the fact is that most experts are purely speculating. Even digital currency is far from bullet-proof. As we’ve seen, both the global pandemic and the Russia-Ukraine War have caused price drops.

The truth is that we won’t know its survivability until we go through another recession. Gold, however, has already proven to be a recession-proof asset.

Will Cryptocurrency Ever Replace Gold?

Most experts agree that cryptocurrency will never fully replace gold, even though they have become more similar. However, there is a trend that Crypto might become the go-to inflation hedge. If you take a look at a gold and Bitcoin correlation chart, it will show how closely related Bitcoin has become to gold. Some even show gold vs. silver vs. Bitcoin.

Will Gold Go up in 2022?

At the beginning of March, gold hit its highest price since August of 2020. The price jump comes after many investors sought gold as their safe haven investment through the Russia-Ukraine War.

It has since gone back down, but don’t expect it to drop by much. Despite everything happening in the world right now, it is predicted that gold prices will reach over US$2,200 per ounce in 2022.

Is It Better to Invest in Gold or Crypto?

By now, you’re probably asking, “should I invest in gold or Bitcoin?” Without knowing your exact financial situation and current investment strategy, we can’t give you a straight answer on whether or not to trade Bitcoin for gold. However, we can tell you that through centuries, gold has proven to be a stable asset that you can’t go wrong with.

If you are dead-set on investing in digital currency, you could consider gold or silver-backed crypto. This allows you to dip your toe in the cryptocurrency world while still having some security that precious metals allow.

Can You Buy Gold with Crypto?

The straightforward answer is yes! You can buy gold with Bitcoin in your digital wallet by selecting Bitcoin as your payment method. You can even buy gold with Ethereum if it is accepted by the broker. We recommend that you check with your dealer or broker to find out if you can trade Bitcoin for gold.

Learn More About Adding Gold to Your Investment Portfolio

Are you ready to trade Bitcoin for gold? Do you want to know more about Bitcoin vs. silver? If you answered yes, then you’re in the right place. IPM is here to help you with all of your gold and precious metal investing needs. Call us or submit our online form to get in contact with one of our helpful representatives.

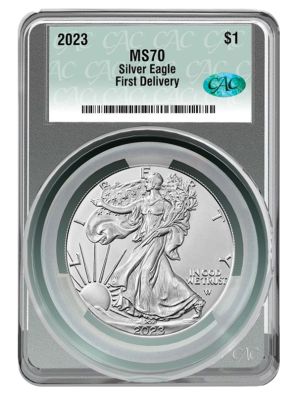

If you’re interested in reading more about precious metals, check out some of our other great posts including, ‘Are Palladium Coins A Good Investment?’, ‘Key Date Gold & Silver American Eagles and ‘Why Buying Precious Metals Will Keep You Safe From A Stock Market Crash’.