Why is Gold So Expensive?

Gold Price Over Time

The current price of gold per ounce is nearing its all-time high over the past century, as the price of Gold over time has grown remarkably. In 1915, gold was at $462.84 an ounce. The price per ounce remained fairly steady until February of 1980, when the price per ounce shot up to $2004.11. By 1982, the price was below $1,000 and followed a downturn for the next two decades. The price for an ounce began climbing again in late 2001 and has risen steadily to the current $1,231 per ounce.

Why Is Gold So Valuable?

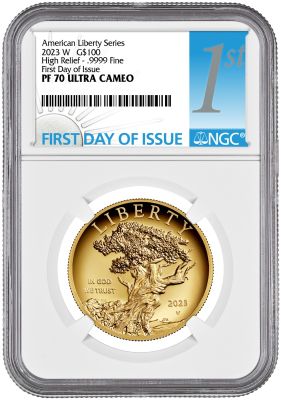

It is never a bad time to buy an asset for less than its replacement cost and gold currently costs near, but not above, its production cost. Production costs are rising along with the price of gold and mining companies are racing to produce more. For the medium term, there seems to be a low likelihood that production costs or demand for the yellow metal will drop. Also, the most powerful function of gold, the most convertible of all the precious metals, is its performance as a hedge against inflation and the continuing devaluation of the American dollar. The cost of not diversifying is far more expensive than gold in the long term.

Are Silver or Platinum the Solution?

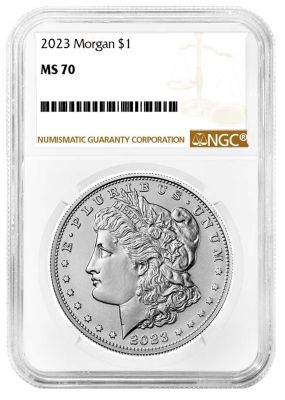

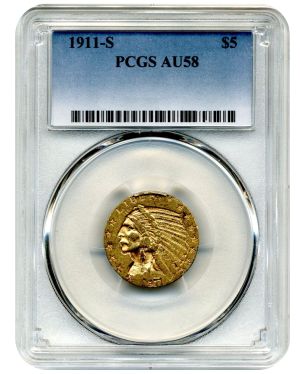

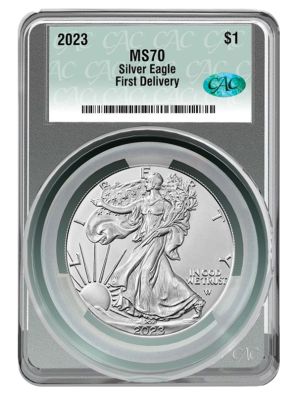

Historically, silver has been the most affordable precious metal. Silver is the most electrically and thermally conductive and reflective metal on earth. It is also the most readily used metal with no known substitutes and currently silver inventories are at record lows. Another precious metal option is platinum. Platinum is used in one of every five consumer products. Platinum's scarcity and its industrial demand combine to make it a solid asset with great potential. Platinum bullion, both in terms of coins and generic bars, are a popular choice among previous metals.

Why is Gold Worth More Than Other Metals?

In terms of what is the most precious metal, the question directs toward both silver and platinum, which have many characteristics which make them valuable. (And to a lesser degree, palladium bullion). However, the indisputable fact remains that gold is worth more. The question is why? The short answer: abundance and popularity. Gold is a very rare element that can only be produced in limited quantities. Currently mining operations are only able to produce approximately 2,500 metric tons annually, regardless of the need or desire for the precious metal. Gold is indestructible, malleable and extremely portable. And though other precious metals like silver are just as liquid, the higher demand for gold makes it the more liquid of the two.

Is Gold A Good Long Term Investment?

Gold is versatile in its ability to perform as currency, commodity, and an investment. Is Gold A Good Long Term Investment? Gold investment advice in 2015 dictates that you must look at worldwide instability such as rising oil prices and rising government indebtedness, all of which combine to shake up local currencies. This makes gold a much safer investment. Investors the world over regard gold as a means to protect wealth and hedge against uncertainty. The inverse relationship between gold and the U.S. dollar makes gold a wealth protection measure against deflation, devaluation and inflation.

Feel free to learn more about precious metals and valuable coins by checking out our other unique blog posts, including Is Copper A Precious Metal, Everything You Need To Know About The 1776 Continental Dollar & Why Is Silver So Cheap.

Tags